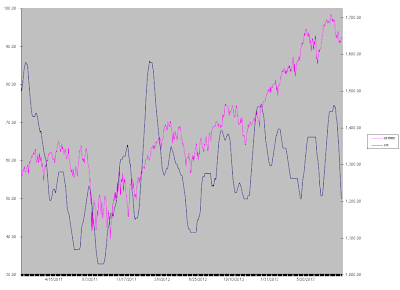

After reaching a high in the low-to-mid 70's in last month or two, my Price/Volume Diffusion Index (PVDI) has rolled over. Reflecting the weakening supply/demand dynamics in volume results in conjunction with a decline in the price of the S&P 500.

The PVDI now sits right on the 50 demarcation level, down from the short-term high above 70. Indicators at or above the 50 demarcation suggest higher equity price in the future.

However, the summation index (a raw compilation/computation of data feeding into the diffusion index) is in a downtrend, with both the trend of the S&P 500 and the volume dynamics tilted negatively. The summation index, at times, serves an early indicator of potential trend changes in the diffusion index, and although the index can turn quickly, the weaker volume levels on the upside suggest this as an unlikely scenario in the short term.

More so, the slope of the summation index continues to weaken, accentuating the weakening supply/demand trends.

I anticipate discussing the PVDI somewhat more than I have considering the index sits on an inflection point.

The PVDI now sits right on the 50 demarcation level, down from the short-term high above 70. Indicators at or above the 50 demarcation suggest higher equity price in the future.

However, the summation index (a raw compilation/computation of data feeding into the diffusion index) is in a downtrend, with both the trend of the S&P 500 and the volume dynamics tilted negatively. The summation index, at times, serves an early indicator of potential trend changes in the diffusion index, and although the index can turn quickly, the weaker volume levels on the upside suggest this as an unlikely scenario in the short term.

I anticipate discussing the PVDI somewhat more than I have considering the index sits on an inflection point.

No comments:

Post a Comment