Saturday, September 28, 2013

Friday, September 27, 2013

Calling out FDR and Other Great Thoughts, Ron Paul On the Tonight Show

At least someone calls out FDR for the awful leader that he was.

Ron Paul - Tonight Show with Jay Leno 9/26/13 by RonPaulFriends

Ron Paul - Tonight Show with Jay Leno 9/26/13 by RonPaulFriends

Is Alpha Dead

Is alpha 'dying' because of the synchronization of asset class performance and the push out of risk taking due to QE?

Bubbles On the Brain

New Research from the journal Neuron suggests that financials bubbles have neurological underpinnings. The research suggests that during bubble periods in the markets, peoples' brain activate in areas suggesting value judgement processing and social issues.

Reading through the research is a little convoluted but still interesting. That said, I think the research can be more easily described by stating that people tend to follow others who executed operating models that work because it saves times and energy relearning a task that apparently works. It also makes sense in an evolutionary sense. You and caveman 2 hunt and forage for food. Caveman 2 knows where to find the best fruit and easiest prey. Are you going to set on your own to find your own (uncertain) sources of food or follow cavemen 2? Following caveman 2 expands less energy and increases your chance of survival.

The fact is, we are not that far away, temporal speaking, from that hunter and forager. Add in the modern social context of missing the boat, and bubbles become increasing hard for investors to not participate.

This analysis does not even address the 'professional' aspects of missing the rise in asset prices and the extent it threatens careers. Far easier to be wrong in a group than stand alone with the wrong answer.

Reading through the research is a little convoluted but still interesting. That said, I think the research can be more easily described by stating that people tend to follow others who executed operating models that work because it saves times and energy relearning a task that apparently works. It also makes sense in an evolutionary sense. You and caveman 2 hunt and forage for food. Caveman 2 knows where to find the best fruit and easiest prey. Are you going to set on your own to find your own (uncertain) sources of food or follow cavemen 2? Following caveman 2 expands less energy and increases your chance of survival.

The fact is, we are not that far away, temporal speaking, from that hunter and forager. Add in the modern social context of missing the boat, and bubbles become increasing hard for investors to not participate.

This analysis does not even address the 'professional' aspects of missing the rise in asset prices and the extent it threatens careers. Far easier to be wrong in a group than stand alone with the wrong answer.

Price/Volume Diffusion Index Remains Above 50 But......

To provide you an update on the latest Price/Volume Diffusion Index (PVDI) results, the most recent index came in at a level above the 54 demarcation. This level remains above the 50 demarcation, suggesting that the equity markets will remain in an uptrend. The chart below updates the PVDI for the most recent trading days.

PVDI

Although the PVDI remains above the 50 demarcation, I would suspect that this optimistic reading may be either short lived or at the very least we will see the PVDI turn down. The PVDI, just by the nature of the math involved in its calculation will lag market prices or the immediate turns in the S&P 500.

For that, you should look at the summation index, which feeds into the PVDI, and the slope of the summation index. I show both below.

Summation Index

Slope of the summation index

You will notice that although the PVDI remains positive and pointing upward, the summation index has rolled over. This is while the slope of the summation index remains in a downtrend. Both suggest to me that the a ever increasing PVDI is not in the cards. All together, I see PVDI and the associated indexes pointing towards higher equity prices, but on weakening internal demand dynamics.

PVDI

Although the PVDI remains above the 50 demarcation, I would suspect that this optimistic reading may be either short lived or at the very least we will see the PVDI turn down. The PVDI, just by the nature of the math involved in its calculation will lag market prices or the immediate turns in the S&P 500.

For that, you should look at the summation index, which feeds into the PVDI, and the slope of the summation index. I show both below.

Summation Index

Slope of the summation index

You will notice that although the PVDI remains positive and pointing upward, the summation index has rolled over. This is while the slope of the summation index remains in a downtrend. Both suggest to me that the a ever increasing PVDI is not in the cards. All together, I see PVDI and the associated indexes pointing towards higher equity prices, but on weakening internal demand dynamics.

To Taper Or Not To Taper, That Is the Question

As I have stated and shown in previous posts, despite the Fed's very public discussion, the growth rates in base money and the money stock has been slowing. This led me to to conclusion that a taper, of sorts, was already in play.

That was a few weeks ago, and I thought you may interested in an update. Looking at current figures, the 'taper' pressure has alleviated to a certain degree. Lets turn to the charts.

13-week annualized M2 money stock

13-week annualized base money

The growth rates in both M2 money stock and base money have perked up a bit versus when I warned about the slowdown a number of weeks ago. That said, neither money figure has given a significant 'all clear' signal. First off, M2 money stock is increasing at a rate above 6%, but the acceleration looks to be slowing. More so, the trend in base money growth still looks to be a slow protracted decline.

The growth in money stock, if it remains in a low or decelerating trend could indicate that economic growth and inflation rates are also at risk. Additionally, slowing trend growth may also suggest that an actual pullback in the Fed's $85 billion monthly bond buying program may just be a pipe dream.

That was a few weeks ago, and I thought you may interested in an update. Looking at current figures, the 'taper' pressure has alleviated to a certain degree. Lets turn to the charts.

13-week annualized M2 money stock

13-week annualized base money

The growth rates in both M2 money stock and base money have perked up a bit versus when I warned about the slowdown a number of weeks ago. That said, neither money figure has given a significant 'all clear' signal. First off, M2 money stock is increasing at a rate above 6%, but the acceleration looks to be slowing. More so, the trend in base money growth still looks to be a slow protracted decline.

The growth in money stock, if it remains in a low or decelerating trend could indicate that economic growth and inflation rates are also at risk. Additionally, slowing trend growth may also suggest that an actual pullback in the Fed's $85 billion monthly bond buying program may just be a pipe dream.

Gassing Up for Higher Price- Natural Gas That Is

It has been a while since I discussed the machinations in the natural gas markets. Plainly stated, there just was not anything that interesting going on. Prices have been range bound while supply remained on the higher side of the 5-year average. However, something interesting happened in yesterday's trading. Just look at the chart.

High volume, wide price spread, a close near the high, these are all indicators of a possible trend change occurring. Not to mention that move occurred in or around a swing point in the natural gas contract, solidifying the move even more. More interesting to note was that yesterday's move occurred after the Energy Information Administration stated the lasted weekly storage build came in well North of estimates at 87 Bcf. The contract sold off initially on the news, but rallied sharply there after.

The move indicates to me a change in trend in natural gas contract and that traders are expecting some combination of lower supply, higher demand, much cooler winter temperatures, or some disruption in the shale-gas plays.

High volume, wide price spread, a close near the high, these are all indicators of a possible trend change occurring. Not to mention that move occurred in or around a swing point in the natural gas contract, solidifying the move even more. More interesting to note was that yesterday's move occurred after the Energy Information Administration stated the lasted weekly storage build came in well North of estimates at 87 Bcf. The contract sold off initially on the news, but rallied sharply there after.

The move indicates to me a change in trend in natural gas contract and that traders are expecting some combination of lower supply, higher demand, much cooler winter temperatures, or some disruption in the shale-gas plays.

Get Your Christmas Shopping Done Now.... No Seriously

I have watched this a few times and was thinking about getting some for the kids. Then I thought, forget the kids.

And in case you are wondering what the other 2% is made..... the website Geekologie states.....

Kinetic Sand, a sand play toy made from 98% sand, and 2% Polydimethyl siloxane, a "silicon-based organic polymer...particularly known for its unusual rheological (or flow) properties."

So ya, for anyone who was asleep or just skipped their advanced chemistry 303 class, polydimethyl siloxane is a compound made up of silicon, hydrogen, oxygen, and or course carbon. As the source of knowledge, Wikipedia, states the compound is a clear, inert, non-toxic polymer with unique 'flow' properties found in all sorts of products from contact lenses, shampoo, and food. Hmmm, polydimethyl siloxane.

And in case you are wondering what the other 2% is made..... the website Geekologie states.....

Kinetic Sand, a sand play toy made from 98% sand, and 2% Polydimethyl siloxane, a "silicon-based organic polymer...particularly known for its unusual rheological (or flow) properties."

So ya, for anyone who was asleep or just skipped their advanced chemistry 303 class, polydimethyl siloxane is a compound made up of silicon, hydrogen, oxygen, and or course carbon. As the source of knowledge, Wikipedia, states the compound is a clear, inert, non-toxic polymer with unique 'flow' properties found in all sorts of products from contact lenses, shampoo, and food. Hmmm, polydimethyl siloxane.

That's All We Got- Price/Volume Heat Map for 9/26 Trading Day

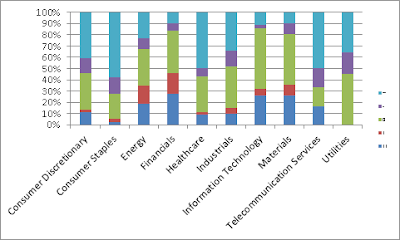

I am joking a bit in the headline, but that was the rally? The market's gain of about 30 basis points in value in yesterday's trading was just limp. Most of the gains were predicated on the nearly 1% increase in value for discretionary stocks.

Worse still, demand remained tepid at best. The gains in yesterday's trading look largely due to just churn and a general selling exhaustion, whatever does not go down must go up. Worse still, the gains in equity prices resulted from extraordinarily weak volume levels overall. I still would not be surprised to see a viscous nap back to the upside, but for now sellers rule the roost.

Worse still, demand remained tepid at best. The gains in yesterday's trading look largely due to just churn and a general selling exhaustion, whatever does not go down must go up. Worse still, the gains in equity prices resulted from extraordinarily weak volume levels overall. I still would not be surprised to see a viscous nap back to the upside, but for now sellers rule the roost.

What If the Typical Family Spent Like the US Federal Government

But raising the debt ceiling won't add to the debt.

Bad Data Hurting the US Economy- Biderman

The moral of the story, use non-seasonally adjusted number where you can and make year-over-year comparisons in any analysis.

Thursday, September 26, 2013

Hidden Secrets Of Money 3 - Dollar Crisis To Golden Opportunity

Seeing the the gold repatriation announcements on a timeline was stunning.

Fed May Take 3 Years to Normalize- Dr. Doom

My guess, normalization will take longer. Probably as long as it takes market participants to forget what the old normal was.

In any event, here are Roubini's comments

In any event, here are Roubini's comments

Why Candy Crush Is Brilliant and You Can't Copy It.... a Disruptive Innovation

The premise a little faulty, as many have copied the formula in the recent past to various degrees of success, but the message does not change. The commentator(s) also miss the bigger story here. Social, free, online games are also a disruptive innovative upsetting the ecosystem of the game console markers. They open up gaming to all new customers who have not historical played video games at very attractive price points. Nintendo, Sony, and Microsoft just cannot compete against free.

Libertarianism Is Non-Intervention, Actual History Of Great Depression/Economics of 20th Century- Paul

Ron Paul as interviewed by Charlie Rose

Equity Demand Remain choppy, Price/Volume Heat Map for 9/25 Trading Day

Still no sign of demand in the equity markets. I suppose investors are turning their attention and (investable funds) to the bond markets, as the long-bond rates have fallen, on their way to what looks like the 200-day moving average. As usual, I provide the breakdown of the daily sector performance below, which at first glance seems mixed.

I would not be surprised if we do not see some snap back rally in the short-term here. We have seen five trading days of lower demand dynamics on overall decelerating volume levels. Provided this setup and considering that equity prices broke to new highs last Wednesday (considering the notion that a break to new highs suggests further new highs), I would not be surprised at all to see a volatile regressive action to upside here shortly. Looking at yesterday's price/volume heat map, the supply/demand dynamics look more choppy versus the last few trading days. Does this suggest a changing trend? We shall see,

I would not be surprised if we do not see some snap back rally in the short-term here. We have seen five trading days of lower demand dynamics on overall decelerating volume levels. Provided this setup and considering that equity prices broke to new highs last Wednesday (considering the notion that a break to new highs suggests further new highs), I would not be surprised at all to see a volatile regressive action to upside here shortly. Looking at yesterday's price/volume heat map, the supply/demand dynamics look more choppy versus the last few trading days. Does this suggest a changing trend? We shall see,

Still Weakness in Gold Market- Kitco News

Although gold has sold off following the rip higher after last week's FOMC meeting, the gold complex has sold off.... as Kitco news points out here

In my opinion, the sell off is due, in part, to the belief that the Fed's tapering (outright) will occur later this year. Investors can argue over the merits of economic health and how this will affect the Fed's decision, but I am thinking that given Bernanke's recent comments (or Yellen's dovishness if you will, considering she is the supposed front runner on the printing presses) and weak economic figures a pullback in bond buying is unlikely this year. This should only help the gold complex.

More so, the technical outlook also suggests higher prices in gold in the intermediate term. Last Wednesday's move gold and gold equities came on extremely high volume and wide price spreads at or near the previous swing point. Essentially, the move puts a strong floor under the gold complex. However and outside of investors selling on the anticipation of a taper later this year, I think the recent decline just represents weak hands getting of the market. Now would be the time to accumulate.

In my opinion, the sell off is due, in part, to the belief that the Fed's tapering (outright) will occur later this year. Investors can argue over the merits of economic health and how this will affect the Fed's decision, but I am thinking that given Bernanke's recent comments (or Yellen's dovishness if you will, considering she is the supposed front runner on the printing presses) and weak economic figures a pullback in bond buying is unlikely this year. This should only help the gold complex.

More so, the technical outlook also suggests higher prices in gold in the intermediate term. Last Wednesday's move gold and gold equities came on extremely high volume and wide price spreads at or near the previous swing point. Essentially, the move puts a strong floor under the gold complex. However and outside of investors selling on the anticipation of a taper later this year, I think the recent decline just represents weak hands getting of the market. Now would be the time to accumulate.

Abusrd Ideas

This quote has resonated with me over the last few days...

"If at first, the idea is not Absurd, then there is no hope for it"- Einstein

"If at first, the idea is not Absurd, then there is no hope for it"- Einstein

Wednesday, September 25, 2013

Subscribe to:

Comments (Atom)