Oil has traded up in recent weeks, on lower crude oil stocks (it is the summer driving season, but catapulted on the turmoil in Egyptian politics and recent oil-related accidents (see the train derailment in Canada and the spill in the Gulf of Mexico).

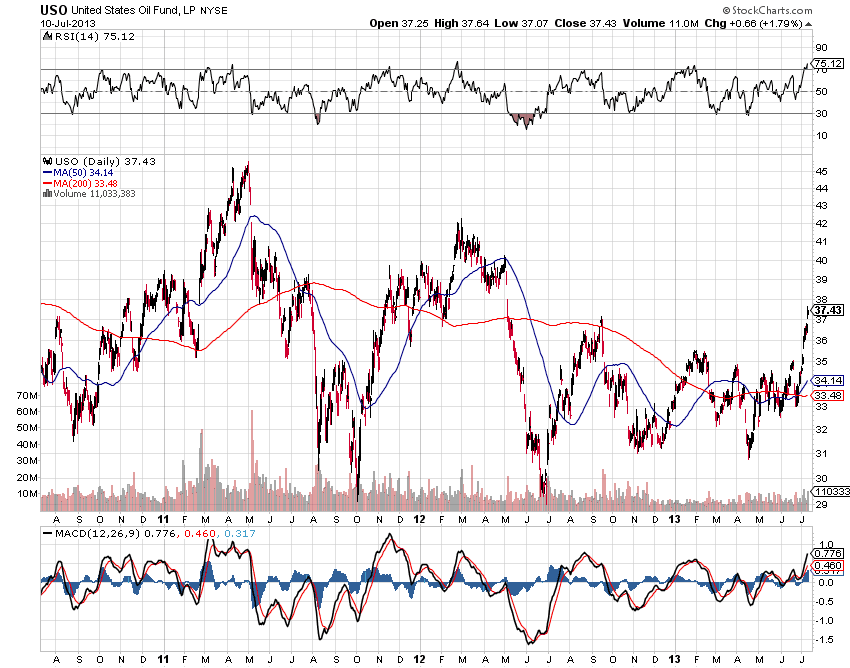

It is my belief that oil that oil price gains are overdone at this point, driven primarily by exogenous events. The United States Oil Fund (ticker USO), the ETF that tracks oil prices, is now trading up past $37 per share, into the mid-2012 downdraft. The volume levels on the latest upswing, albeit picking up, are only about half of the supply line in our around the $38 level. The latter price point is where the USO faltered in early 2012 and about the price level where the fund gravitated to in 2011. This suggests to me there will be sellers coming into the market in around current price levels, and I am fading the price of oil at the current price level.

It is my belief that oil that oil price gains are overdone at this point, driven primarily by exogenous events. The United States Oil Fund (ticker USO), the ETF that tracks oil prices, is now trading up past $37 per share, into the mid-2012 downdraft. The volume levels on the latest upswing, albeit picking up, are only about half of the supply line in our around the $38 level. The latter price point is where the USO faltered in early 2012 and about the price level where the fund gravitated to in 2011. This suggests to me there will be sellers coming into the market in around current price levels, and I am fading the price of oil at the current price level.

No comments:

Post a Comment