If you are not reading the weekly commentary from John Hussman (found here) then you are truly missing out. I have found his comments and analysis to be some of the best, most thought provoking, and profound comments from any fund company, investors, etc. This weeks comments provide great insights into an evidenced-based outlook for the market and the box Bernanke et. al. have painted themselves in to. This is a fantastic read.

Late-Stage, High-Risk

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

Reprint Policy

Late-Stage, High-Risk

John P. Hussman, Ph.D.

All rights reserved and actively enforced.

Reprint Policy

For investors who don’t rely much on historical

research, evidence, or memory, the exuberance of the market here is

undoubtedly enticing, while a strongly defensive position might seem

unbearably at odds with prevailing conditions. For investors who do

rely on historical research, evidence, and memory, prevailing conditions

offer little choice but to maintain a strongly defensive position.

Moreover, the evidence is so strong and familiar from a historical

perspective that a defensive position should be fairly comfortable

despite the near-term enthusiasm of investors.

There are few times in history when the S&P

500 has been within 1% or less of its upper Bollinger band (two

standard deviations above the 20-period moving average) on daily,

weekly and monthly resolutions; coupled with a Shiller P/E in excess of

18 – the present multiple is actually 22.3; coupled with advisory

bullishness above 47% and bearishness below 27% - the actual figures

are 51% and 24.5% respectively; with the S&P 500 at a 4-year high

and more than 8% above its 52-week moving average; and coupled, for good

measure, with decelerating market internals, so that the

advance-decline line at least deteriorated relative to its 13-week

moving average compared with 6-months prior, or actually broke that

average during the preceding month. This set of conditions is

observationally equivalent to a variety of other extreme syndromes of

overvalued, overbought, overbullish conditions that we've reported over

time. Once that syndrome becomes extreme - as it has here - and you get

any sort of meaningful "divergence" (rising interest rates,

deteriorating internals, etc), the result is a virtual Who's Who of

awful times to invest.

Consider the chronicle of these instances in

recent decades: August and December 1972, shortly before a bull market

peak that would see the S&P 500 lose half of its value over the

next two years; August 1987, just before the market lost a third of its

value over the next 20 weeks; April and July 1998, which would see the

market lose 20% within a few months; a minor instance in July 1999

which would see the market lose just over 10% over the next 12 weeks,

and following a recovery, another instance in March 2000 that would be

followed by a collapse of more than 50% into 2002; April and July 2007,

which would be followed by a collapse of more than 50% in the S&P

500, and today.

The prior instances were sometimes followed by

immediate market losses, and were sometimes characterized by extended

top formations - which produce a sort of complacency as investors say

“see, the market may be elevated and investors may be over-bullish, but

the market is so resilient that it’s ignoring all that, so

there’s no reason to worry.” Ultimately, however, the subsequent plunges

wiped out far more return than investors achieved by remaining

invested once conditions became so extreme. We are in familiar

territory, but that territory generally marks the mouth of a vortex.

Based on ensemble methods that capture a century

of evidence – from Depression-era data, through the New Deal, World

War, the Great Society, the electronics boom, the energy crisis,

stagflation, the great moderation, the dot-com bubble, the tech crash,

the housing bubble, the credit crisis, and even the more recent period

of massive central bank interventions – our estimates of prospective

market return/risk have been negative since April 2010 and have

remained negative even as new data has arrived. Since early March, those

estimates have plunged into the most negative 0.5% of historical

instances.

It’s worth noting that the S&P 500 posted a

negative total return between April 2010 and November of last year. Of

course, the market has also enjoyed a risk-on mode since then. Through

Friday, the S&P 500 has achieved a total return of nearly 25% since

our return/risk estimates turned negative in early 2010. Defensiveness

has clearly been taxing in that respect. But this doesn’t remove the

question of whether the market’s recent gains are durable, much less

whether they will be extended. Corporate insiders certainly don’t seem

to think so – their sales have tripled since July, to a rate of six

shares sold for each share purchased.

Far from being some novel “new era” environment,

present conditions – rich valuations, overbought trends, lopsided

bullishness, heavy insider sales, and lagging market internals – are

part of a historical syndrome that is very familiar in the sense that

we’ve repeatedly seen it prior to the worst market declines on record.

But as the chronicle above should make clear, this doesn’t make our

short-term experience any easier, because these conditions can emerge,

go dormant for a few months while the market retreats modestly, and

then reappear as the market registers a marginal new high. The ultimate

outcome has historically been spectacularly bad, but it still takes

patience and discipline to stay on the sidelines during late-stage,

high-risk advances. Of course, the present instance may turn out

differently than every prior instance has – it’s just that we have no

basis to expect that outcome.

Economic Notes

The most interesting feature of last week’s

“decision” by the European Central Bank was the continued eagerness of

investors to hear what they want to hear, rather than what is actually

said. With little doubt, what investors think they heard was

that the ECB has finally decided to launch a new program by which it

will begin purchasing Italian and Spanish debt in unlimited – unlimited – amounts, putting an emphatic end to European debt strains, and decisively ensuring the future unity of the Euro.

Here is what the European Central Bank actually said:

“A necessary condition for Outright Monetary

Transactions is strict and effective conditionality attached to an

appropriate European Financial Stability Facility/European Stability

Mechanism (EFSF/ESM) programme. Such programmes can take the form of a

full EFSF/ESM macroeconomic adjustment programme or a precautionary

programme (Enhanced Conditions Credit Line), provided that they include

the possibility of EFSF/ESM primary market purchases. The involvement

of the IMF shall also be sought for the design of the country-specific

conditionality and the monitoring of such a programme.”

If you wondered why Angela Merkel and the whole of

Germany was not immediately up in arms, it is because prior to

transactions by the ECB, the receiving country would have to submit to

an adjustment program, ideally involving the IMF. This is nothing like

what Spain has been asking for, which is for the ECB to make unconditional

purchases. To benefit from the proposed OMT program, these countries

have to subordinate their fiscal policy to outside conditionality.

What if they don’t?

“The Governing Council will consider Outright

Monetary Transactions to the extent that they are warranted from a

monetary policy perspective as long as programme conditionality is

fully respected, and terminate them once their objectives are achieved

or when there is non-compliance with the macroeconomic adjustment or

precautionary programme.”

But assuming these countries accept the

adjustment programs, at least they can be assured that the ECB will buy

their debt in unlimited amounts, can’t they?

“No ex ante quantitative limits are set on the size of Outright Monetary Transactions.”

Read carefully – the ECB did not promise

“unlimited” financing. Rather, it refused to specify an amount in

advance (ex-ante), because it doesn’t want the markets to look at some

inadequately small and fixed number and begin to speculate against the

ECB as soon as that particular number is approached. By refusing to set

a specific amount in advance, Draghi said in his press conference that

he wanted the policy to be perceived as fully effective. But

perception substitutes for reality only for so long. If Merkel, Monti

and Rajoy were stranded on a mountaintop and Merkel was the only one

with a bag of muesli, she might offer some to the other two without

specifying an amount in advance, but there’s no doubt she’d be slapping

it out of their hands if things got out of control.

Finally, “The liquidity created through Outright Monetary Transactions will be fully sterilised.”

This last provision is likely to both calm

Germans and inflame them. Sterilization means that for every euro of

Spanish or Italian bonds the ECB buys (creating new euros in the process), it will drain euros by selling

some other security – most likely bonds of Germany, Holland, Finland,

or other stronger European nations. This will help to calm Germans

because it indicates that the overall supply of euros will not expand.

It will also inflame them, however, because the existing stock of euros

will now have been created to provide fiscal support to Spain, Italy

and other troubled countries, while Germany, Holland, Finland and

stronger countries will not have benefited at all from the money

creation.

It will be interesting how this plays on

September 12, when the German Constitutional Court is set to decide on

the legality of the European bailout funds, the EFSF and the ESM

(technically, the Court will rule on an injunction against even passing

it into law, but will not formally rule on constitutionality until

possibly next year). My expectation is that they will rule that these

mechanisms are in fact allowable and consistent with the

German Constitution. Where it gets interesting is whether they will

rule that it is allowable to leverage these mechanisms or operate with a

banking license (which would make Germany’s existing contribution

“capital” that could be wiped out, leaving Germany on the hook for

much, much larger amounts - which essentially cedes fiscal authority

from the German people to the ESM). I suspect that there is a fair

chance that the Court will add language in their ruling to reject that

possibility, which may force the idea of a “big bazooka” back to square

one. We’ll see.

---

Here in the U.S., Friday’s August employment

report was surprisingly weak relative to Wall Street’s expectations,

though hundreds of thousands of workers abandoned the labor force,

which allowed the unemployment rate to decline. Relative to our own

expectations, the figure was elevated, as I expect that the August

employment figure will ultimately be revised to a negative reading. This would be consistent with revisions that we’ve seen around prior recession starting points.

For example, if you look at the originally

reported data for May through August 1990, you’ll see 480,000 total

jobs created (see the October 1990 vintage in Archival Federal Reserve Economic Data). But if you look at the revised data as it stands today, you’ll see a loss

of 81,000 jobs for the same period. Look at January through April

2001, at the start of that recession. The vintage data shows a total

gain of 105,000 jobs during those months, while the revised data now

shows a loss of 262,000 jobs. Fast forward to February through

May 2008, and though you’ll actually see an originally-reported job

loss during that period of 248,000 jobs, the revised figures are still

dismal in comparison, now reported at a loss of 577,000 jobs for the

same period. As other good economic analysts have recognized, economic

time series tend to be revised after-the-fact, with upward revisions in

periods just before the recession begins, and downward revisions in

periods just after the recession begins. I continue to believe that the

U.S. joined an unfolding global recession, most probably in June of

this year.

---

Ahead to QE3. A week ago, The Wall Street Journal ran a piece by Jon Hilsenrath titled Will Fed Act Again? Sizing Up Potential Costs.

The article reviewed concerns about additional quantitative easing,

noting that inflation has remained muted and the dollar has remained

firm. Both of those outcomes were presented as evidence counter to Fed

Governor Charles Plosser’s concern that “Without appropriate steps to

withdraw or restrict the massive amount of liquidity that we have made

available… the inflation rate is likely to rise to levels that most

would consider unacceptable.”

There is strong evidence to suggest that this is

little but false comfort. While we don’t expect material inflationary

pressures until the back-half of this decade, the Federal Reserve has

increasingly placed itself into a position that will be nearly

impossible to disgorge without enormous disruption. Specifically, the

U.S. economy could not achieve a non-inflationary increase in Treasury

bill yields to even 2% without requiring a nearly 50% reduction in the

Federal Reserve’s balance sheet.

This point is easily demonstrated in data from

1947 to the present. The relationship between short-term interest rates

and the amount of monetary base per dollar of nominal GDP is very

robust, and is widely recognized as the “liquidity preference” curve.

We are already way out on the flat part of this curve. Note that

Treasury bill yields have never been at even 2% except when there was

less than 10 cents of base money per dollar of nominal GDP. There are

only 3 ways to get there from the current 18 cents – dramatically cut

the balance sheet, keep interest rates near zero for the next decade (assuming nominal GDP growth of 5% annually), or accept much higher rates of inflation than most would consider acceptable.

Moreover, with a portfolio duration that we now

estimate at about 8 years, historically low yields on Treasury

securities, and a Fed balance sheet currently leveraged about 53-to-1

against the Fed’s own capital, an increase in long-term yields of

anything more than 20 basis points a year would produce capital losses

sufficient to wipe out interest income, making the Fed effectively

insolvent, and turning monetary policy into fiscal policy.

On the subject of Fed leverage, it is one thing to

purchase long-dated bonds when yields are high. It is another to

purchase them when yields are at record lows and very small yield

changes are capable of wiping out all interest income and leaving the

Fed in a loss position when it is already levered 53-to-1 (2.9 trillion

of assets on 54.6 billion of capital, according to the Fed’s

consolidated balance sheet). At a 10-year Treasury yield of just 1.6%

and a portfolio duration of about 8 years (meaning that a 100 basis

point move causes a change of about 8% in the value of the securities

held by the Fed), it takes an interest rate increase of only about 20

basis points (1.6/8) to wipe out a year of interest on the portfolio

held by the Fed and push it into capital losses. It would then take

another 24 basis points to wipe out all of the capital on the

Fed’s balance sheet. Of course, they don’t mark the balance sheet to

market. So the public might not be aware of those losses, but that

would only mean that we would have an insolvent Fed printing money on

an extra-Constitutional basis to fund its own balance sheet losses

instead of public spending.

Based on a report from UBS (h/t ZeroHedge),

the Federal Reserve now holds all but $650 billion of outstanding

10-30 year Treasury securities, with UBS warning “a large, fixed size

QE program could cause liquidity to tank”, with a similar outcome in

the event that the Fed pursues mortgage-backed securities instead. A

couple of years ago, Bernanke asserted in a 60 minutes interview that

“We could raise interest rates in 15 minutes if we have to. So there is

really no problem in raising interest rates, tightening monetary

policy, slowing the economy, reducing inflation, at the appropriate

time.” Really? Tell that to Paul Volcker, who had to deal with enormous

inflation at unemployment rates even higher and a monetary base

dramatically smaller than we observe at present.

The Fed now holds virtually no Treasury debt of

maturity of less than 3 years, as Operation Twist and other efforts

have been designed to force investors to choke on short-dated paper

yielding next to nothing, in hopes of forcing them into riskier

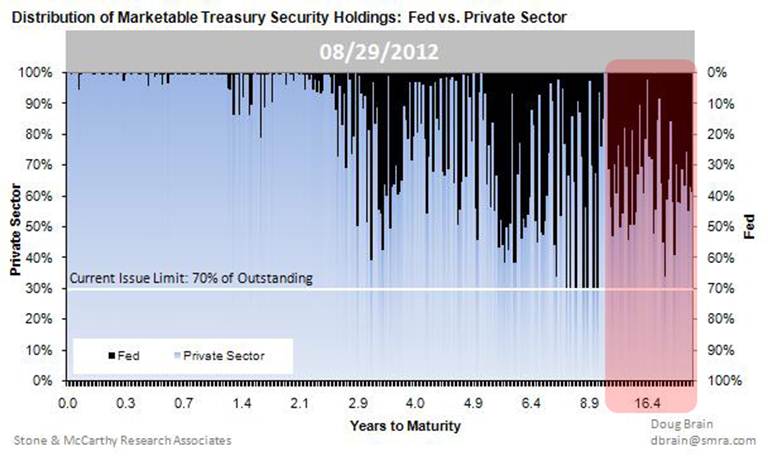

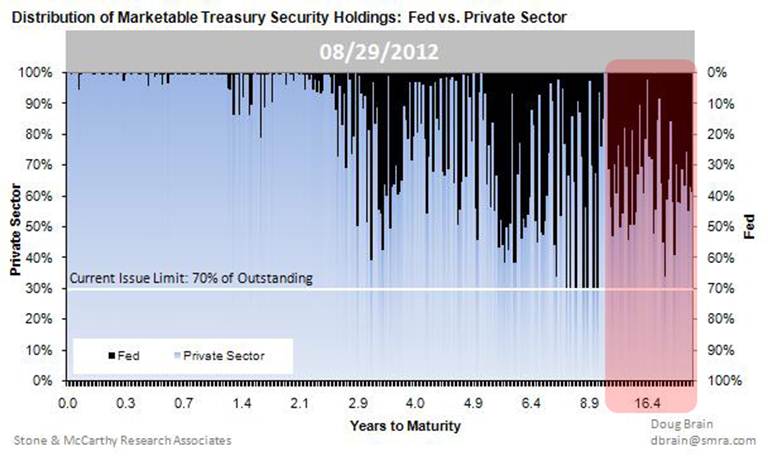

securities. The chart below shows the distribution of Fed holdings

(dark bars) versus private sector holdings of Treasury debt, at various

maturities. Of course, in equilibrium, someone still has to

hold the short-dated Treasury securities, in addition to about $2.7

trillion in zero-interest cash and bank reserves, until those

securities, currency, and reserves are retired. To believe that an

unwinding of the Fed’s present balance sheet would not be disruptive is

full-metal make-believe.

Good economic policy acts to relieve some binding

constraint on the economy. How does the Fed argue that base money is a

binding constraint? At present, there are trillions of dollars held as

idle reserves on bank balance sheets. While a “portfolio balance”

perspective may well suggest that additional zero-interest reserves

will force more investors into risky assets at the margin (which has

been most effective after significant market declines over the prior

6-month period), so what? There is no historical evidence that changes

in stock market value have a significant effect on GDP. Indeed, a 1%

change in stock market value is associated with a change of only

0.03-0.05% in GDP, largely because individuals consume off of their

expectation of “permanent income”, not off of transitory changes in

volatile securities.

In regard to why inflation has remained low, a

useful way to see the relationship between the monetary base, interest

rates, GDP and inflation is the “exchange equation”: MV = PQ, where M

is base money, V is velocity, P is prices, and Q is real output. As is

evident from the liquidity preference chart, base velocity (PQ/M) is

tightly related to short-term interest rates. In fact, as long as

short-term interest rates fall in response to increases in the monetary

base, those increases have virtually no effect on real output, but

instead translate almost directly into declines in velocity. Again,

some data from 1947 to the present:

If the decline in velocity exactly offsets the

increase in base money, inflation is not going to explode overnight.

But this happy outcome is brought to you by the passive response of

short-term interest rates and the willingness of the public to

accumulate zero-interest assets, which is in turn the result of strong

and legitimate concerns about credit risk, default risk, and economic

weakness. But remove any of those factors, or allow any other exogenous

upward pressure on short-term interest rates, and the result will be

upward pressure on velocity. Barring enormous rates of real GDP growth,

the only way to counter that, as the first chart suggests, will be

through either massive (and potentially disruptive) contraction of the

Federal Reserve’s balance sheet, or acceptance of undesirable rates of

inflation.

As hedge funds often discover, and JP Morgan

recently learned, it is very easy to get into a position that later

turns out to be nearly impossible to exit smoothly. A significant

reduction in the Fed’s balance sheet is unlikely to be achieved at

long-term interest rates nearly where they are now, which implies

capital losses on the Fed account, which implies that in contemplating a

further round of quantitative easing, the Federal Reserve is

effectively contemplating a fiscal policy action.

Unfortunately, they’re likely to do it anyway.

From an investment perspective, it’s important to

consider the potential effect of additional quantitative easing. As I

noted several weeks ago (see What if the Fed Throws a QE3 and Nobody Comes?),

the effect of prior rounds of quantitative easing both in the U.S. and

abroad has generally been limited to little more than a recovery of

the loss that the stock market sustained over the prior 6-month period.

Presently, the S&P 500 is at a 4-year high, valuations are rich on

the basis of normalized earnings, and advisory sentiment exceeds 50%

bulls – over twice the number of bearish advisors according to Investors

Intelligence. In recent years, each round of QE emerged closely on the

heels of a significant market loss that produced a spike in risk

premiums. In that environment, expanding the stock of zero-interest

rate assets had the effect of bringing those risk premiums back down to

those observed over the prior 6-months or so, and more recent

interventions have shown diminishing returns. At present, risk-premiums

are already depressed and there is no 6-month loss to recover.

In short, even the evidence of the past several

years does not support the automatic assumption that stock prices will

advance in the event of another round of QE at present levels. With

little doubt, the market is likely to enjoy some immediate cheer from

that sort of move, particularly if the Fed refrains from providing a

specific ex-ante limit on its purchases - allowing investors to rejoice

in the perception that the Fed had launched “unlimited” QE. Still,

that cheer may be short-lived. If we examine the way that QE actually

operates, and how and why risk premiums have responded to prior rounds,

it is entirely unclear that a further round will have much effect

beyond an initial spike of enthusiasm. That is, unless one adopts a

superstitious faith that stocks will rise in response to QE, since QE

makes stocks rise, because QE equals stocks rising, with no further

analysis needed.

No comments:

Post a Comment