Saturday, March 2, 2013

Price/Volume Diffusion Index 3/1 Edition

Just a quick update on the Price/Volume Diffusion Index. Starting with the positive, the slope of the rolling summation index has fully turned from recent lows, albeit still down from the highs late last year. This most fully reflects the upturn in equities prices since the beginning of November last year, which has translated into a high summation index over that time. The most recent track of the slope of summation index is shown below.

Additionally, the diffusion index remains well above the 50 demarcation that signifies an expansion in price, currently at 68.3. That said, the diffusion index appears to be flatlining at this level, as the summation index, the raw data input into the diffusion index, has fallen a few points the high in the last two weeks. This is presented in the charts below.

Price/Volume Diffusion Index

Rolling Summation Index

Downside volume has been picking in recent trading sessions. This is the S&P 500 pushes into the November and December 2007 downdrafts. I would say this setup would suggest caution, but that the bias remains to the upside at the moment.

Additionally, the diffusion index remains well above the 50 demarcation that signifies an expansion in price, currently at 68.3. That said, the diffusion index appears to be flatlining at this level, as the summation index, the raw data input into the diffusion index, has fallen a few points the high in the last two weeks. This is presented in the charts below.

Price/Volume Diffusion Index

Rolling Summation Index

Downside volume has been picking in recent trading sessions. This is the S&P 500 pushes into the November and December 2007 downdrafts. I would say this setup would suggest caution, but that the bias remains to the upside at the moment.

Why gold Declined- An overview from Schiff

How did I miss this........Schiff lays out the case for gold, much of which jives with my own thesis.

First Images From Sub Glacial Lake

Now these images don't seem like much, but if you think about it they are pretty cool. Cool not only because the lake(s) the scientist are drilling in to are pristine locations untouched and unseen for millennia, but cool also because these runs are the precursors to future trips to off world locations. For instance, Europa- which we know has a sub-ice sheet ocean- or other moons like Ganymede or Callisto, which are suspected to have oceans.

The next mission, sampling the lake for microbes.

The next mission, sampling the lake for microbes.

Clearing the Mind

It is requisite for the relaxation of the mind that we make use, from time to time, of playful deeds and jokes.- Thomas Aquinas

Took some time spend with the kids and family. Aquinas was most definitely correct.

Took some time spend with the kids and family. Aquinas was most definitely correct.

Thursday, February 28, 2013

Bernanke Tries to Have His Cake and Eat it Too

Have to love the hypocrisy in this clip. Just remember, the housing bubble- predicated on the rise in housing prices that resulted from the Fed cutting rates following the previously engineered bubble- really had nothing to do with the Fed cutting rates, but the rise on housing prices are now a result of the Fed cutting rates. Got that. Bernanke is trying to have his cake and eat it too.

GDP Revised Up But Recession Risks Remain Elevated

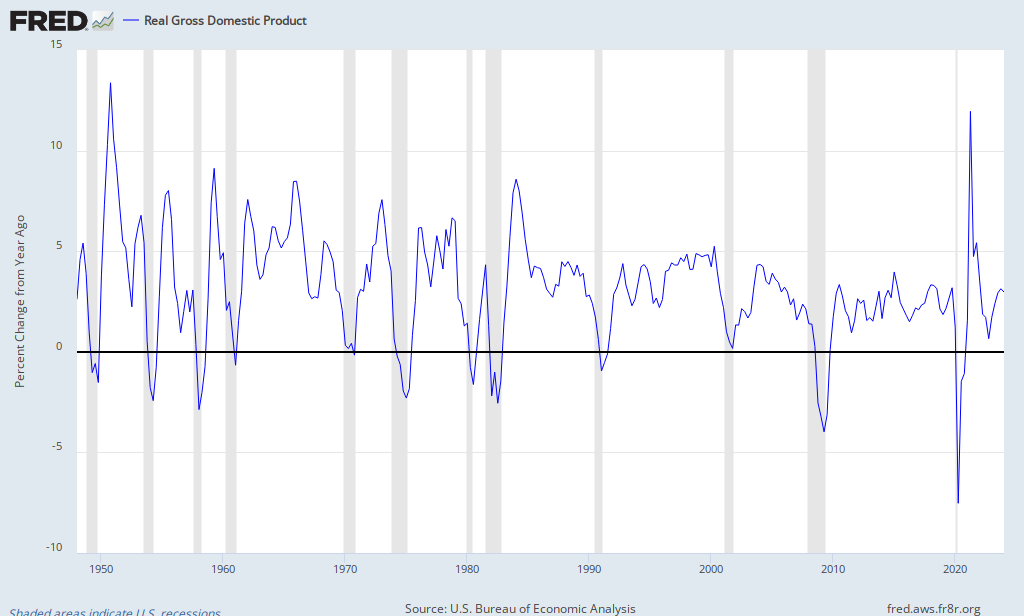

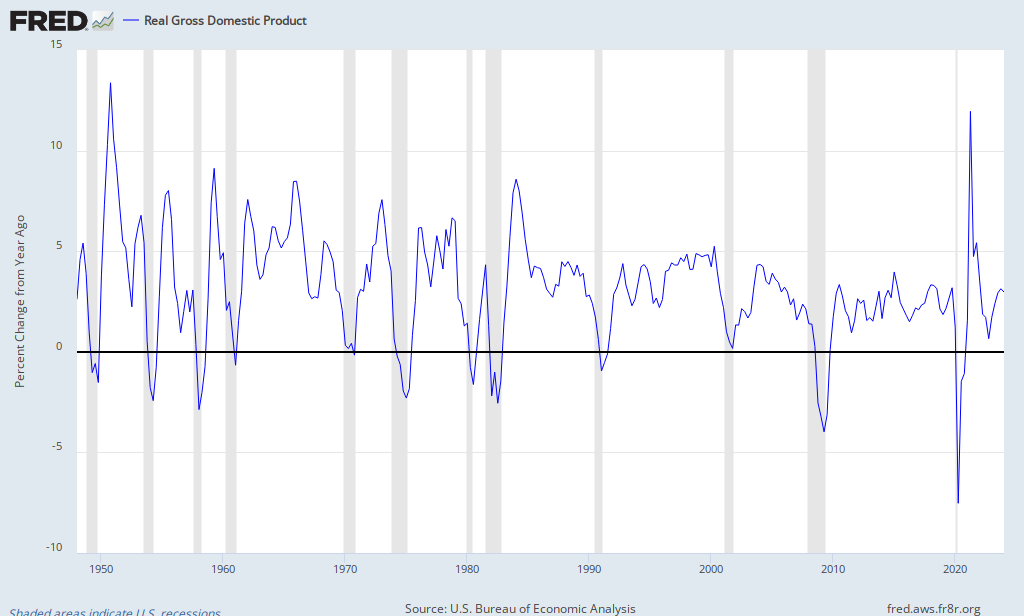

As you probably know, the BEA released their second estimate on fourth quarter GDP earlier this morning. Growth was revised up to 0.1% annualized rate from a -0.1% decline stated in the advanced estimate. Additionally, the year-on-year growth rate went to 1.6% from 1.5%. Essentially, the GDP estimates were unchanged. More importantly and in my opinion, the figures still suggest that GDP is at or near stall speed and that recessionary condition risks are elevated.

As you can in the chart below (via. the St Louis Fed), year-over-year GDP growth around 1.5% has typically preceded an outright contraction in the economy. This is especially true in regards with the directional change in GDP prior to the observation.

As you can in the chart below (via. the St Louis Fed), year-over-year GDP growth around 1.5% has typically preceded an outright contraction in the economy. This is especially true in regards with the directional change in GDP prior to the observation.

Turning to the revisions, the positive revision of 0.1% in year-over- growth really does make a difference in the historical context, as it pertains to recessionary risks. I had described in prior posts that stall speed GDP was pegged at a rate of 1.5% or less, predominantly based on comments from Art Cashin, and created models that calculated historical forward GDP growth figures that bore this out. Following this morning's upward revision however, I reran the models inputting the 1.6% rate versus the 1.5% previously.

Low and behold, the revision really made no difference and it still appears we remain at stall speed. The historical two quarter median change in GDP was a -0.7% following periods when a contraction in GDP growth figured its was down to 1.6% or less. This compares to a total population median GDP growth of 3.1%. Additionally, GDP tends to show growth in most quarters, expanding roughly 88% of all quarters since the early 1940's. This compares to a batting average of less than 50% when GDP has fallen to stall speed.

Although the historical context may not completely describe our current condition, I think it does suggest that recessional risks are higher than most assume.

Wednesday, February 27, 2013

Bearish Case Against Gold Falling Apart

Two of the bearish cases against gold and gold stocks that has developed in recent weeks has been that the Fed was imminently ready to raise rates and reduce its balance sheet..... which has been nearly invalidated by Bernanke's testimony and recent Fed officials. The second pillar has been the idea that the European economy was improving. Well so much for that.

First, we had comments from Lars Feld, an economic adviser to Germany's Merkel, stated in Handelsblatt (source Zerohedge).....

Additionally, the Eurozone Retail PMI indicates continued weakness for European retailers.

First, we had comments from Lars Feld, an economic adviser to Germany's Merkel, stated in Handelsblatt (source Zerohedge).....

The Italian economy would not find their way out of the recession, according to the pessimistic assessment by Lars Feld: "The sustainability of Italian public finances is in jeopardy. The euro crisis will therefore return shortly with a vengeance."

Apparently, the Italians were not ready to move on the path of reform that has been taken by Mr. Mario Monti, Field said.

"You can not expect that Italy's European partners or the ECB will stabilize the Italian economy, when its people are not ready for reform."

Additionally, the Eurozone Retail PMI indicates continued weakness for European retailers.

The bear thesis for gold was apparently that an improving economy would lead to a pullback in central bank QE efforts. Ya, that is going to happen.

Subscribe to:

Comments (Atom)