The below video is a reply of an interview with Jim Grant where Mr. Grant lays out his probabilistic outlook resultant from the Federal Reserve's efforts. Enjoy

Friday, August 29, 2014

Thursday, August 28, 2014

The End of The Bottoming Process with Ronald Stoeferle

Mr. Stoeferle. managing director at Incrementum AG, lays out the case for the end of the bottoming process now underway in gold and what this could mean for precious metal investors.

While the followings provide a background around various future scenarios based on growth and inflation/deflation assumptions.

While the followings provide a background around various future scenarios based on growth and inflation/deflation assumptions.

Blaming That Cold Weather Culprit- Neo-Keynesians Wrong Again

via Mises.org

In February, the Federal Reserve made a cursory observation that the unusually severe winter was partly to blame for the stagnant pace of the US economy. The news media, ranging from liberal to conservative, all highlighted the Fed’s report and provided their respective “spin” on how the weather damages the economy. But soon enough, focus turned back to the brutally cold temperatures and not winter’s economic impact.

Recently, however, the Commerce Department reported that the US economy actually contracted 2.9 percent in the first quarter of 2014. This was the Department’s third attempt at revising its figures, with previous reports estimating first 0.1 percent growth and then a 1.0 percent contraction. While this little statistical “revision” was inconvenient, it was quickly followed (in true Orwellian fashion) by a slew of reports confirming that the economy has already rebounded and the second quarter will be even better than previously anticipated. (According to an advanced estimate released last week by the Bureau of Economic Analysis, GDP increased 4.0 percent in the second quarter and the first quarter’s numbers were revised yet again.)

Naturally, the “blame the weather” campaign popped up again. In fact, Gus Faucher, Vice President and Senior Macroeconomist with PNC in Pittsburgh, estimates that over half of the contraction can be blamed on the severe winter weather. Well, this certainly begs the question, “Can weather actually cause the economy to contract?”

Weather obviously affects the economy. However, the claim that weather can actually drag down the economy is dubious at best. While severe winter weather may slow construction, idle auto sales, and reduce ice cream consumption, the economy never goes into hibernation. Instead, economic activity simply shifts.

A great analogy is household consumption spending. Each month, the average household allocates a certain amount of disposable income to entertainment. How this money is spent — at restaurants, traveling, shopping malls, or the theater — is irrelevant. The point is that people tend to budget a relatively fixed amount of income toward leisurely pursuits. If a new restaurant opens to rave reviews or a blockbuster movie debuts, a young couple does not drastically increase their monthly budget to accommodate the new entertainment options. Instead, consumption spending may shift from the mall or the theater to dinner and a movie. Similarly, a family that is planning a big vacation or a day at the ballpark either budgets additional savings throughout the year or scales back other expenses. To assume that new retail options magically increase spending is flawed economics.

Likewise, severe winters merely shift economic activity. While it’s true that companies may postpone construction projects and consumers will spend less time outside, the economy does not grind to a halt.

Instead, companies often use the post-holiday lull to complete annual inventory, update quality control initiatives, or install new technology. Further, while some retailers like ice cream vendors, department stores, and restaurants may see sales slump, others will inevitably see sales increase because consumers tend to stay indoors, dine at home, stock up on emergency supplies, and watch more television. In more real terms, Ben & Jerry’s and Baskin-Robbins may suffer, but Amazon, Netflix, and the local grocery store might see sales spike. This cyclical effect is natural.

There are spillover effects, as well. More movie downloads boosts the telecommunications industry. Trips to the grocery store and internet purchases mean more deliveries, which means work for the shipping giants (even after accounting for weather delays). What’s more, the economy is so interconnected that an increase in cold weather deliveries inevitably means additional strain on trucks and equipment. This, in turn, may help hardware stores, mechanics, and parts distributors. Not to mention that severe winter weather inevitably leads to increased spending on utilities, snow removal, and industrial equipment, like plows, snow blowers, and chainsaws. These spillover effects go on and on.

In addition, every winter there is always an uptick in travel as people escape the bitter cold, which raises revenues for the airline and tourism industries. Meanwhile, some travel destinations actually embrace winter’s cold. In fact, this past season, most ski resorts in the United States opened earlier and had their best season in years. (Predictably, this summer’s unseasonably cool temperatures are being blamed for dismal attendance at pools and resorts across the country.)

Finally, economic growth and consumption spending are not intrinsically connected. Purchasing power does not evaporate just because spending may slow during the cold winter months. Instead, saving increases investment opportunities and may boost the bottom line for companies like Wells Fargo, Edward Jones, and E*TRADE. This may, in turn, boost the stock market and possibly even the share price of Unilever and Dunkin' Brands (the corporate parents of Ben & Jerry’s and Baskin-Robbins) even when consumers are craving hot chocolate over ice cream treats.

While weather may affect the economy, the recent contraction has little to do with winter’s bitter cold; the US economy is far too diverse and complex. Instead, we are witnessing the ongoing effects of failed monetary and fiscal policies. As the Wickersham Commission noted years ago, “These laws [of economics] cannot be destroyed by governments, but often in the course of human history governments have been destroyed by them.”

In February, the Federal Reserve made a cursory observation that the unusually severe winter was partly to blame for the stagnant pace of the US economy. The news media, ranging from liberal to conservative, all highlighted the Fed’s report and provided their respective “spin” on how the weather damages the economy. But soon enough, focus turned back to the brutally cold temperatures and not winter’s economic impact.

Recently, however, the Commerce Department reported that the US economy actually contracted 2.9 percent in the first quarter of 2014. This was the Department’s third attempt at revising its figures, with previous reports estimating first 0.1 percent growth and then a 1.0 percent contraction. While this little statistical “revision” was inconvenient, it was quickly followed (in true Orwellian fashion) by a slew of reports confirming that the economy has already rebounded and the second quarter will be even better than previously anticipated. (According to an advanced estimate released last week by the Bureau of Economic Analysis, GDP increased 4.0 percent in the second quarter and the first quarter’s numbers were revised yet again.)

Naturally, the “blame the weather” campaign popped up again. In fact, Gus Faucher, Vice President and Senior Macroeconomist with PNC in Pittsburgh, estimates that over half of the contraction can be blamed on the severe winter weather. Well, this certainly begs the question, “Can weather actually cause the economy to contract?”

Weather obviously affects the economy. However, the claim that weather can actually drag down the economy is dubious at best. While severe winter weather may slow construction, idle auto sales, and reduce ice cream consumption, the economy never goes into hibernation. Instead, economic activity simply shifts.

A great analogy is household consumption spending. Each month, the average household allocates a certain amount of disposable income to entertainment. How this money is spent — at restaurants, traveling, shopping malls, or the theater — is irrelevant. The point is that people tend to budget a relatively fixed amount of income toward leisurely pursuits. If a new restaurant opens to rave reviews or a blockbuster movie debuts, a young couple does not drastically increase their monthly budget to accommodate the new entertainment options. Instead, consumption spending may shift from the mall or the theater to dinner and a movie. Similarly, a family that is planning a big vacation or a day at the ballpark either budgets additional savings throughout the year or scales back other expenses. To assume that new retail options magically increase spending is flawed economics.

Likewise, severe winters merely shift economic activity. While it’s true that companies may postpone construction projects and consumers will spend less time outside, the economy does not grind to a halt.

Instead, companies often use the post-holiday lull to complete annual inventory, update quality control initiatives, or install new technology. Further, while some retailers like ice cream vendors, department stores, and restaurants may see sales slump, others will inevitably see sales increase because consumers tend to stay indoors, dine at home, stock up on emergency supplies, and watch more television. In more real terms, Ben & Jerry’s and Baskin-Robbins may suffer, but Amazon, Netflix, and the local grocery store might see sales spike. This cyclical effect is natural.

There are spillover effects, as well. More movie downloads boosts the telecommunications industry. Trips to the grocery store and internet purchases mean more deliveries, which means work for the shipping giants (even after accounting for weather delays). What’s more, the economy is so interconnected that an increase in cold weather deliveries inevitably means additional strain on trucks and equipment. This, in turn, may help hardware stores, mechanics, and parts distributors. Not to mention that severe winter weather inevitably leads to increased spending on utilities, snow removal, and industrial equipment, like plows, snow blowers, and chainsaws. These spillover effects go on and on.

In addition, every winter there is always an uptick in travel as people escape the bitter cold, which raises revenues for the airline and tourism industries. Meanwhile, some travel destinations actually embrace winter’s cold. In fact, this past season, most ski resorts in the United States opened earlier and had their best season in years. (Predictably, this summer’s unseasonably cool temperatures are being blamed for dismal attendance at pools and resorts across the country.)

Finally, economic growth and consumption spending are not intrinsically connected. Purchasing power does not evaporate just because spending may slow during the cold winter months. Instead, saving increases investment opportunities and may boost the bottom line for companies like Wells Fargo, Edward Jones, and E*TRADE. This may, in turn, boost the stock market and possibly even the share price of Unilever and Dunkin' Brands (the corporate parents of Ben & Jerry’s and Baskin-Robbins) even when consumers are craving hot chocolate over ice cream treats.

While weather may affect the economy, the recent contraction has little to do with winter’s bitter cold; the US economy is far too diverse and complex. Instead, we are witnessing the ongoing effects of failed monetary and fiscal policies. As the Wickersham Commission noted years ago, “These laws [of economics] cannot be destroyed by governments, but often in the course of human history governments have been destroyed by them.”

Four Macro Changes To Watch

Some medium-term macro trends every investor should be mindful of. Another must watch at least once, if not twice, from the Financials Sense Newshour crew.

Equities Heading Higher? With Gartmen on Kitco News

I have always like Gartman, even when I completely disagreed with his thesis. Although I am bear over a long-term view, the S&P 500 making another new record high suggests we will go higher.

Equities aside, Gartman had some interesting comments on gold and QE in interview below.

Equities aside, Gartman had some interesting comments on gold and QE in interview below.

Wednesday, August 27, 2014

A Gain Is a Gain Is A Gain Is A Gain

Well, we saw our sign of a bid right where we should see it if the gold investment complex was to continue its consolidation, which I stated that we see here. That aside, volume levels were weaker than I would have liked, and I cannot discern if this was because the pre-holiday week or if it was operators getting fresh meat into the market. Lets look at the charts....

First the GLD....

... which moved back in to the consolidation trading range.

Then the GDX....

..... bouncing off the floor with some juice and remaining stronger than the metals, a positive signal. This is while RLGD.....

.... also bounced off the floor in to the established trading range, albeit on less.

Look at this way, a gain is a gain is a gain. Prices bouncing off the lows in the precious metal complex suggests to me that remain in consolidation. Another interesting bit of information I thought I would pass on, a dealer stated to me that he was unable to get his hands on any silver. None, nothing and that the Chinese were buying all the physical they could get their hands on. Of course there is no way I can corroborate this information, which may just be dealer shop talk, but this is something to ponder nonetheless.

First the GLD....

... which moved back in to the consolidation trading range.

Then the GDX....

..... bouncing off the floor with some juice and remaining stronger than the metals, a positive signal. This is while RLGD.....

.... also bounced off the floor in to the established trading range, albeit on less.

Look at this way, a gain is a gain is a gain. Prices bouncing off the lows in the precious metal complex suggests to me that remain in consolidation. Another interesting bit of information I thought I would pass on, a dealer stated to me that he was unable to get his hands on any silver. None, nothing and that the Chinese were buying all the physical they could get their hands on. Of course there is no way I can corroborate this information, which may just be dealer shop talk, but this is something to ponder nonetheless.

An Underlying Gold Bid with Peter Hugg

Interestingly, we saw some sign of strength, or the operators trying to get out of positions, tough to tell, where I thought we would see it, as I stated here. That aside and as Hugg describes in the below video, we will not know much until after the labor day holiday. Even more information to ponder, I got word from a precious metals dealer that he was unable to get his hands on any silver. Nothing, none and that the Chinese were buying large amounts of the physical. I don't know if this is just shop rumors or what, but it is something to take notice of.

Tuesday, August 26, 2014

Seven Megatrends That Will Shape the Next

As a side note, if you have not read Megatrends and the sequels by John Naisbitt, you should really go read those books. At the very least use them as primer for the power of megatrends on the business and investment world. Not that the below is related in any sense directly except that they share the megatrend moniker, but while listening I harkened back to Mr. Naisbitt's books and ideas and wonder if the megatrends discussed will have the same potency as the later. This is a video I will watch and listen to multiple times.

Broken Links: Fed Policy and the Growing Gap Between Wall Street and Main Street- John Hussman

I am avid reader of John Hussman and eagerly await his weekly commentary on the markets, economics, and investing climate. Professor Hussman's pieces are usually a good read, but I have to say his latest commentary knocks it out of the park. An excerpt of the piece can be found below and the remainder can be found here

Before the 15th century, people gazed at the sky,

and believed that other planets would move around the Earth, stop, move

backwards for a bit, and then move forward again. Their model of the

world – that the Earth was the center of the universe – was the source

of this confusion.

Similarly, one of the reasons that the economy

seems so confusing at present is that our policy makers are following

models that have very mixed evidence in reality. Worse, when

extraordinary measures don’t produce the desired results, the response

is to double the effort without carefully asking whether there is a

reliable, measurable cause-and-effect relationship in the first place.

When there are broken links in the chain of cause-and-effect, “A causes

B” may be true, and “C causes D” may be true, but if B doesn’t cause

C, then all the A in the world won’t give you D.

Let’s review some relationships in the data that are clear, and some that are not so clear at all.

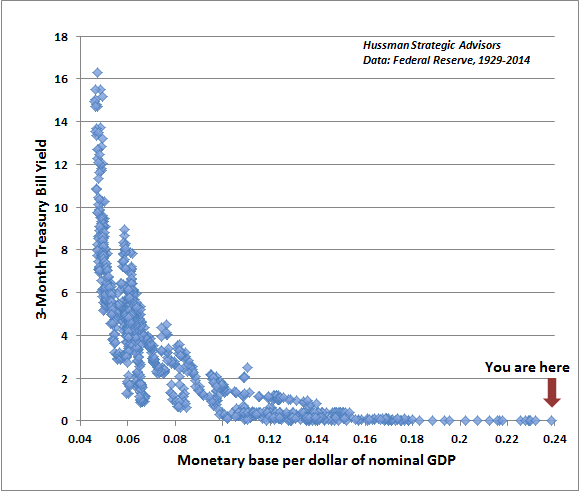

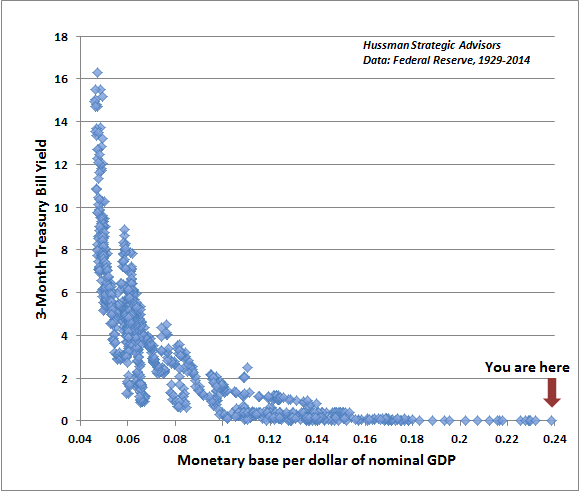

Quantitative easing and short-term interest rates

First, the following chart shows the relationship

since 1929 between the monetary base (per dollar of nominal GDP) and

short-term interest rates. This is our variant of what economists call

the “liquidity preference curve,” and is one of the strongest

relationships between economic variables you’re likely to observe in

the real world. After years of quantitative easing, the monetary base

now stands at 24% of GDP. Notice that less than 16% was already enough

to ensure zero interest rates, so the past trillion and a half dollars

of QE have done little but increase the pool of zero-interest assets

that are fodder for yield-seeking speculation. Notice also that unless

the Fed begins to pay interest to banks on their idle reserves, the Fed

would have to contract its balance sheet by about $1 trillion

just to raise Treasury bill yields up to a fraction of one percent. So

the primary policy tool of the Fed in the next couple of years will

likely be changes in interest on reserves (IOR). Get used to that

acronym.

Hedge Fund Activism, Corporate Governance, and Shareholder Returns

I hope you find this research as fascinating as I did. Although, I have to admit that I have a slanted view on the matter due to having some skin in the game view a recent purchase in a preferred convert of a company that had been the focus of hedge fund activism. In any event, Professor Brav's speech that he eludes to in the below video will discussed here on August 27th.

More so, the professor's research is a good read and may provide some helpful insights in to your own investing.

More so, the professor's research is a good read and may provide some helpful insights in to your own investing.

The Creature From Jekyll Island

I have shown this to you before, but definitely worth while to listen to the speech again.

Scary Day in Gold But.......

Yesterday was an unnerving day for gold investors like myself. Yesterday, albeit the Monday in the week heading into the Labor Day holiday, usually a light trading week where traders can push investments all over the place, was almost the fifth day in a row of losses. Not that we should not expect multiple days of losses, as I stated in a previous post that I would not be surprised that the metals and/or equities don't make a run at the June 13th price point. But still, losses are losses and never sit well.

Light market dynamics heading in to a holiday aside, this will be an important trading week in the gold complex. Despite the five day sell-off, the gold equities refuse to bust the floor established on June 13.....

As I have shown and demonstrated many times, the gold equities tend to lead the price of the yellow metal both on the upside and the downside. We see the above price dynamics as the yellow metal (GLD) has closed the gap of June 19th, a critical price point.

And turning to one of the best proxies for the outlook of precious metals complex, RGLD also sold off hard in yesterday's trading. That said, the stock rejected the lows and a apparent critical price floor around $73.50, as investors' demands for shares pulled the stock back from the abyss.

This trading dynamic suggests that the long gold/gold equity trade may not be over just yet. That said, we will have to see some sign of strength in trading soon with some follow through. And as a side note, gold and the precious metal equities are trading up in early morning trading.

Light market dynamics heading in to a holiday aside, this will be an important trading week in the gold complex. Despite the five day sell-off, the gold equities refuse to bust the floor established on June 13.....

As I have shown and demonstrated many times, the gold equities tend to lead the price of the yellow metal both on the upside and the downside. We see the above price dynamics as the yellow metal (GLD) has closed the gap of June 19th, a critical price point.

And turning to one of the best proxies for the outlook of precious metals complex, RGLD also sold off hard in yesterday's trading. That said, the stock rejected the lows and a apparent critical price floor around $73.50, as investors' demands for shares pulled the stock back from the abyss.

This trading dynamic suggests that the long gold/gold equity trade may not be over just yet. That said, we will have to see some sign of strength in trading soon with some follow through. And as a side note, gold and the precious metal equities are trading up in early morning trading.

Monday, August 25, 2014

How Institutions Decay and Economies Die

This is definitely a review you will want to review more than once.

The Economic Recovery in One Chart

The below chart comes form the Brookings Institute and it shows new business formation and exiting since the late 1970's.

What stands out is that new business creation has always outpaced exits, even through the recessions of the early 1980's, the early 1990's and in the first decade of the current century. That is all up until the current recession. Even though we are experiencing a 'recovery', how strong of a footing can the economy be sitting on if new business creation continues to lag?

What stands out is that new business creation has always outpaced exits, even through the recessions of the early 1980's, the early 1990's and in the first decade of the current century. That is all up until the current recession. Even though we are experiencing a 'recovery', how strong of a footing can the economy be sitting on if new business creation continues to lag?

Terminal Case of Debt Sclerosis with Lacy Hunt

A truly fascinating interview with Lacy Hunt of Hoisington Investment Management looking at the outlook for interest rates and the economy.

Subscribe to:

Comments (Atom)