Come July 1, Google is dropping the axe on Reader. Time to look for a new reader.

http://www.geekosystem.com/feeddemon-vanishing-too/

http://www.geekosystem.com/feeddemon-vanishing-too/

If we compare two static economic systems, which differ in no way from one another except that in one there is twice as much money as in the other, it appears that the purchasing power of the monetary unit in the one system must be equal to half that of the monetary unit in the other. Nevertheless, we may not conclude from this that a doubling of the quantity of money must lead to a halving of the purchasing power of the monetary unit; for every variation in the quantity of money introduces a dynamic factor into the static economic system. The new position of static equilibrium that is established when the effects of the fluctuations thus set in motion are completed cannot be the same as that which existed before the introduction of the additional quantity of money. Consequently in the new state of equilibrium the conditions of demand for money, given a certain exchange value of the monetary unit, will also be different. If the purchasing power of each unit of the doubled quantity of money were halved, the unit would not have the same significance for each individual under the new conditions as it had in the static system before the increase in the quantity of money. All those who ascribe to variations in the quantity of money an inverse proportionate effect on the value of the monetary unit are applying to dynamic conditions a method of analysis that is only suitable for static conditions.Third, he discussed various complications, considering most notably the impact of changes in the demand for money on the PPM (neglected in the traditional theory), as well as inter-local price differences (he denied that they could exist in equilibrium) and the theory of exchange rates (he resuscitated Ricardo’s purchasing-power-parity theorem).

Both changes in the available quantity of production goods or consumption goods and changes in the available quantity of money involve changes in values; but whereas the changes in the value of the production goods and consumption goods do not mitigate the loss or reduce the gain of satisfaction resulting from the changes in their quantity, the changes in the value of money are accommodated in such a way to the demand for it that, despite increases or decreases in its quantity, the economic position of mankind remains the same. An increase in the quantity of money can no more increase the welfare of the members of a community, than a diminution of it can decrease their welfare.[10]Thus right from the outset he makes three fundamental points. One, the real money supply (the aggregate purchasing power of all cash balances) tends to adjust to the real demand for cash balances. Two, as a consequence, the nominal money supply is irrelevant for the services provided by money. Three, as a further consequence, changes in the nominal money supply are equally irrelevant for those services. Only under exceptional circumstances could an increase of the nominal money supply, directly or indirectly, bring about advantages from the overall point of view. Increases of the money supply usually did not tend to increase the supply of consumers’ goods (see A227, A335). They had just an impact on the distribution of those goods. Mises reiterated this point again and again as the starting point for all reflection on the social effects of money.[11]

The principal instrument of monetary policy at the disposal of the state is the exploitation of its influence on the choice of the kind of money. It has been shown above that the position of the state as controller of the mint and as issuer of money substitutes has allowed it in modern times to exert a decisive influence over individuals in their choice of the common medium of exchange. If the state uses this power systematically in order to force the community to accept a particular sort of money whose employment it desires for reasons of monetary policy, then it is actually carrying through a measure of monetary policy. . . . If a country has a metallic standard, then the only measure of currency policy that it can carry out by itself is to go over to another kind of money. It is otherwise with credit money and fiat money.[13]

Comedy according to the theorists of drama is based on inflexibility of character. The lead role cannot in any way bend his stereotyped behaviour even when this would avoid an accident or disaster which is looming. And so “Don Juan” of Molière is a comedy. Even when the ghostly statue of his slain victim threatens to take Don Juan on a fiery descent into hell, the lead character cannot show remorse and desist from his life of debauchery. Chekhov listed his “Cherry Orchard” as a comedy because the lead characters could not shake themselves out of their nonchalance and avoid bankruptcy by selling the cherry orchard of their villa to a property developer on which he would build bungalows.

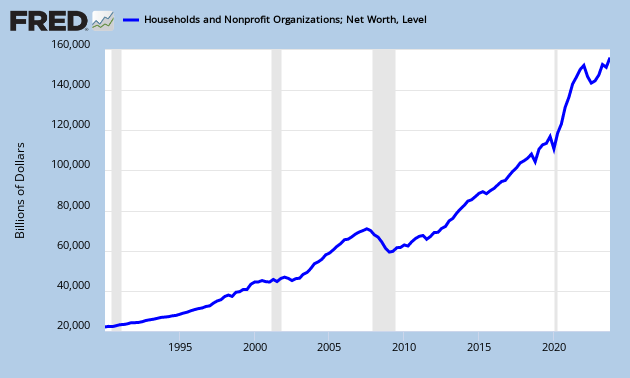

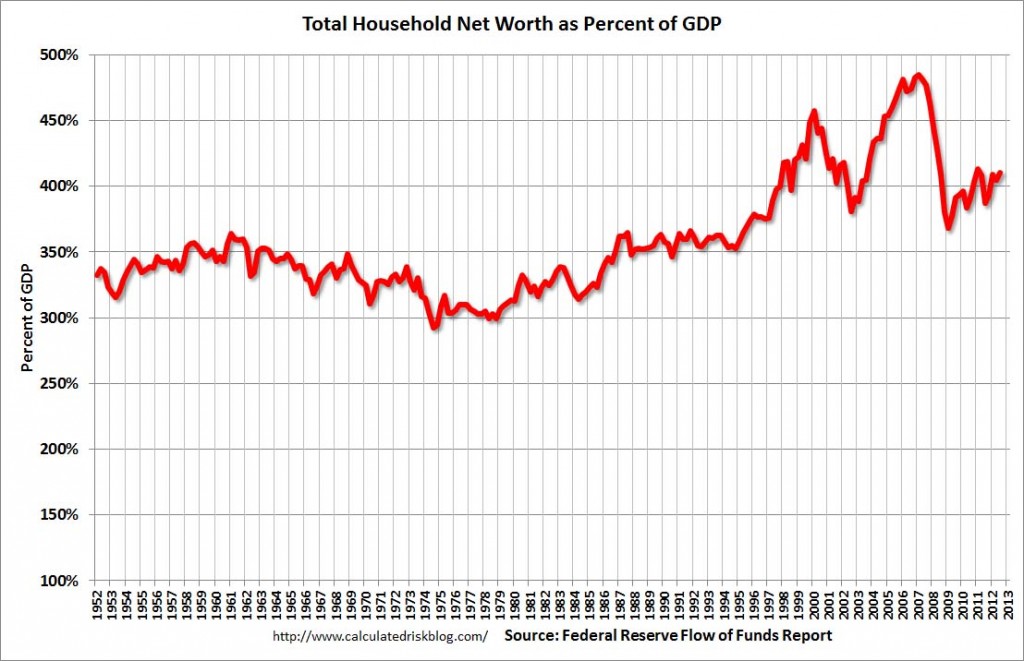

And so we come to the monetary comedy which played out in Washington yesterday. Professor Bernanke, adamant as always that the road to economic prosperity and stability takes the form of a rigorous targeting of inflation and supremely confident in a good outcome to his massive monetary experimentation tells his Congressional questioners that he sees no signs of asset price inflation which would justify changing his present policies. This is the same professor who largely repudiates any concept of asset price inflation and believes totally that any such dangers can be avoided well ahead of time by skilful action on the part of an army of regulators following the recently expanded book of rules. And this is the same professor who denies that monetary disequilibrium played any role in the giant asset and credit market inflations of the last two decades.

There is another element in the monetary comedy under the title of “Fed chair’s semi-annual testimony to Congress.” This is the failure of congressional questioners to hold the professor to account. When he declared that there is no asset price inflation, there was no follow on question such as “but professor you still say there was no asset price inflation in the last great bubble and bust and deny that the Fed of which you were a leading policy maker was in any way responsible: why should we believe you now?” That there should be no such question is part of the comedy, in its literal sense.