According to figures at Marketwatch (http://www.marketwatch.com/Economy-Politics/Calendars/Economic), the Consensus is looking for a June 2012 Purchasing Managers' Index (PMI), as compiled by the Institute of Supply Management (ISM), of 51.5, a full two points lower than the May 2012 print. Although we do not specifically forecast any monthly PMI print, we also believe that the Consensus estimate may be overly pessimistic and that the June 2012 results may surprise to the upside.

What gives us this confidence is the current trend in of the new orders and customer inventories measures along with our analysis historically results. Although you may know and followed the new orders index, most have know very little of the customer inventories index. We believe the customer inventories index is the least followed and understand of the PMI measures, but that it is one of the most important.

The ISM defines the customer inventories index as "the level of inventories the organization's customers have". Like its counterpart measures, the customer inventories index is also a diffusion index, meaning it measures the level of change within a particular group. Unlike the other PMI measures however, the customers inventories index should be thought of counter intuitively. By this we mean that results below 50 are a positive and results above 50 are negative. In actuality, we do not see many customer inventories prints above 50 and results fall within a range around 45.6. This means that results above 45.6 are generally negative while prints below this threshold are positive. As a comparison, the PMI and other measures have a central tendency around 50.

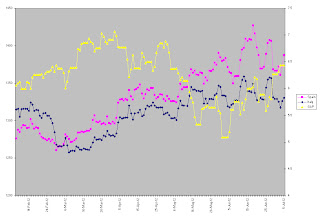

We observe an interesting dynamic with the customer inventories index. It will, and this is intuitive if you think about it, move inversely with the new orders index- i.e. a rising (falling) new orders will correspond with a falling (rising) customer inventories index. More importantly, a low absolute or relative customer inventories index can point to positive PMI measures for at least six months out. For instance, we observbe that since January 1997, the date the ISM began measuring customer inventories, the PMI has never posted a print below 50 in any 6-month period following a customer inventories index tghat was came in at a measure of 42 or lower.

Of course, the latest customer inventory index of print (43.5) is not below the 42 threshold. However, we note that relatively low customer inventory idex measures can be used to guage what the directional change of the PMI in the month ahead period. Our relative analysis uses changes in the new order index over the preceeding 3-month period in regards to low levels in customer inventories. We observe that when the new orders index has increased over the last three months to a measure at or above 55 and the customer inventories index comes in at 43.5 or below, the next months PMI has exhibited a rather strong upward bias. We see that when this dynamic is present, the one month forward PMI rises an average of 0.65 points and shows an increase nearly 60% of all such occurences. This compares to a nearly flat one month change in all PMI measures since January 1997 and the PMI increasing 48% of the time in all monthly periods over the same time period. It is our belief that this occurs because the relatively low level in channel/customer inventory leads to further production and order growth. Thus providing a floor under overall business activity and the PMI.

So what does this mean for the June PMI? Provided that the global economy is slowing and that economic growth in the U.S. appears anemic, we can understand why the Consensus is looking for a sigficant decline in the June PMI. That said, our analysis of the historical PMI results leads us to conclude that the Consensus estimate may be overly pessimistic, with the new orders index climbing over the last three months to a level above 60 and the customer inventories index of 43.5. It is our belief that this dynamic in the May PMI report suggests that low levels in customer inventories will help support further growth in new orders and overll business activity. This leads us to conclude that the June PMI will surpise to upside.