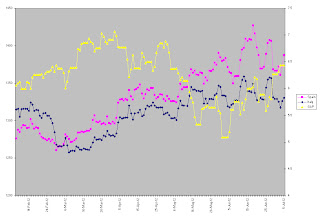

Spanish and Italian bond yields are rising this morning on continued fears and doubts about any impending reforms from the ECB and European Union. The bonds yields of the European periphery have been a decent proxy for the risk on/risk off trade on U.S. stocks, as shown in the below chart.

The most recent decline in the S&P 500 began shortly after both the Italian and Spanish 10-year bond rates started to increase. Correspondingly but not shown, the yields on the 10-year treasury began to decline, as buyers found interest in U.S. bonds despite yields at multi-decade lows. This is likely just another volley in the race-to-the-bottom for world currencies with the bonds for the country exhibiting the least risk at any one time reaping the benefits. We would expect trade to be choppy both today and tomorrow following Independence Day, with many investors taking advantage of the mid-week holiday to extend the weekend.

The risk on trade was alive and well in July 3rd trading, with the S&P gaining 8.5 points or 0.62%. Gold gained 1.5%, silver was up 2.8% while the XAU gained 3.7%. The Dow Jones UBS Commodity index gained nearly 2.7% while Central Appalachian coal gained 0.7% and Powder River Basin coal fell 0.6%. Although the near-term commodity coal futures showed mixed trading, the coal stocks were on fire with Patriot coal up more than 33% (albeit it is a distressed situation), shares of Alpha Natural up 6.4%, and Peabody Energy share up 5.4% to name a few. The coal stock ETF (ticker: KOL) gained 3.7%.

No comments:

Post a Comment