Wednesday, November 27, 2013

Pre-Holiday Slowdown- S&P 500 Price/Volume Heat for Nov. 26

Not much going on on either end of the spectrum, as we approach the Thanksgiving holiday in the US. With that, the price/volume heat map is presented with little comment.

Overall, the supply/demand levels appear mixed. That is aside from the utilities sector, which not only sold off considerably on a price basis but the sell off came on higher relative volume levels.

Overall, the supply/demand levels appear mixed. That is aside from the utilities sector, which not only sold off considerably on a price basis but the sell off came on higher relative volume levels.

The Story Of Thanksgiving You Missed

Funny that I was never taught that bit of history in school.

By Richard J. Maybury at the Mises Institute

Each year at this time school children all over America are taught the official Thanksgiving story, and newspapers, radio, TV, and magazines devote vast amounts of time and space to it. It is all very colorful and fascinating.

It is also very deceiving. This official story is nothing like what really happened. It is a fairy tale, a whitewashed and sanitized collection of half-truths which divert attention away from Thanksgiving's real meaning.

The official story has the pilgrims boarding the Mayflower, coming to America and establishing the Plymouth colony in the winter of 1620-21. This first winter is hard, and half the colonists die. But the survivors are hard working and tenacious, and they learn new farming techniques from the Indians. The harvest of 1621 is bountiful. The Pilgrims hold a celebration, and give thanks to God. They are grateful for the wonderful new abundant land He has given them.

The official story then has the Pilgrims living more or less happily ever after, each year repeating the first Thanksgiving. Other early colonies also have hard times at first, but they soon prosper and adopt the annual tradition of giving thanks for this prosperous new land called America.

The problem with this official story is that the harvest of 1621 was not bountiful, nor were the colonists hardworking or tenacious. 1621 was a famine year and many of the colonists were lazy thieves.

In his 'History of Plymouth Plantation,' the governor of the colony, William Bradford, reported that the colonists went hungry for years, because they refused to work in the fields. They preferred instead to steal food. He says the colony was riddled with "corruption," and with "confusion and discontent." The crops were small because "much was stolen both by night and day, before it became scarce eatable."

In the harvest feasts of 1621 and 1622, "all had their hungry bellies filled," but only briefly. The prevailing condition during those years was not the abundance the official story claims, it was famine and death. The first "Thanksgiving" was not so much a celebration as it was the last meal of condemned men.

But in subsequent years something changes. The harvest of 1623 was different. Suddenly, "instead of famine now God gave them plenty," Bradford wrote, "and the face of things was changed, to the rejoicing of the hearts of many, for which they blessed God." Thereafter, he wrote, "any general want or famine hath not been amongst them since to this day." In fact, in 1624, so much food was produced that the colonists were able to begin exporting corn.

What happened?

After the poor harvest of 1622, writes Bradford, "they began to think how they might raise as much corn as they could, and obtain a better crop." They began to question their form of economic organization.

This had required that "all profits & benefits that are got by trade, working, fishing, or any other means" were to be placed in the common stock of the colony, and that, "all such persons as are of this colony, are to have their meat, drink, apparel, and all provisions out of the common stock." A person was to put into the common stock all he could, and take out only what he needed.

This "from each according to his ability, to each according to his need" was an early form of socialism, and it is why the Pilgrims were starving. Bradford writes that "young men that are most able and fit for labor and service" complained about being forced to "spend their time and strength to work for other men's wives and children." Also, "the strong, or man of parts, had no more in division of victuals and clothes, than he that was weak." So the young and strong refused to work and the total amount of food produced was never adequate.

To rectify this situation, in 1623 Bradford abolished socialism. He gave each household a parcel of land and told them they could keep what they produced, or trade it away as they saw fit. In other words, he replaced socialism with a free market, and that was the end of famines.

Many early groups of colonists set up socialist states, all with the same terrible results. At Jamestown, established in 1607, out of every shipload of settlers that arrived, less than half would survive their first twelve months in America. Most of the work was being done by only one-fifth of the men, the other four-fifths choosing to be parasites. In the winter of 1609-10, called "The Starving Time," the population fell from five-hundred to sixty.

Then the Jamestown colony was converted to a free market, and the results were every bit as dramatic as those at Plymouth. In 1614, Colony Secretary Ralph Hamor wrote that after the switch there was "plenty of food, which every man by his own industry may easily and doth procure." He said that when the socialist system had prevailed, "we reaped not so much corn from the labors of thirty men as three men have done for themselves now."

Before these free markets were established, the colonists had nothing for which to be thankful. They were in the same situation as Ethiopians are today, and for the same reasons. But after free markets were established, the resulting abundance was so dramatic that the annual Thanksgiving celebrations became common throughout the colonies, and in 1863, Thanksgiving became a national holiday.

Thus the real reason for Thanksgiving, deleted from the official story, is: Socialism does not work; the one and only source of abundance is free markets, and we thank God we live in a country where we can have them.

By Richard J. Maybury at the Mises Institute

Each year at this time school children all over America are taught the official Thanksgiving story, and newspapers, radio, TV, and magazines devote vast amounts of time and space to it. It is all very colorful and fascinating.

It is also very deceiving. This official story is nothing like what really happened. It is a fairy tale, a whitewashed and sanitized collection of half-truths which divert attention away from Thanksgiving's real meaning.

The official story has the pilgrims boarding the Mayflower, coming to America and establishing the Plymouth colony in the winter of 1620-21. This first winter is hard, and half the colonists die. But the survivors are hard working and tenacious, and they learn new farming techniques from the Indians. The harvest of 1621 is bountiful. The Pilgrims hold a celebration, and give thanks to God. They are grateful for the wonderful new abundant land He has given them.

The official story then has the Pilgrims living more or less happily ever after, each year repeating the first Thanksgiving. Other early colonies also have hard times at first, but they soon prosper and adopt the annual tradition of giving thanks for this prosperous new land called America.

The problem with this official story is that the harvest of 1621 was not bountiful, nor were the colonists hardworking or tenacious. 1621 was a famine year and many of the colonists were lazy thieves.

In his 'History of Plymouth Plantation,' the governor of the colony, William Bradford, reported that the colonists went hungry for years, because they refused to work in the fields. They preferred instead to steal food. He says the colony was riddled with "corruption," and with "confusion and discontent." The crops were small because "much was stolen both by night and day, before it became scarce eatable."

In the harvest feasts of 1621 and 1622, "all had their hungry bellies filled," but only briefly. The prevailing condition during those years was not the abundance the official story claims, it was famine and death. The first "Thanksgiving" was not so much a celebration as it was the last meal of condemned men.

But in subsequent years something changes. The harvest of 1623 was different. Suddenly, "instead of famine now God gave them plenty," Bradford wrote, "and the face of things was changed, to the rejoicing of the hearts of many, for which they blessed God." Thereafter, he wrote, "any general want or famine hath not been amongst them since to this day." In fact, in 1624, so much food was produced that the colonists were able to begin exporting corn.

What happened?

After the poor harvest of 1622, writes Bradford, "they began to think how they might raise as much corn as they could, and obtain a better crop." They began to question their form of economic organization.

This had required that "all profits & benefits that are got by trade, working, fishing, or any other means" were to be placed in the common stock of the colony, and that, "all such persons as are of this colony, are to have their meat, drink, apparel, and all provisions out of the common stock." A person was to put into the common stock all he could, and take out only what he needed.

This "from each according to his ability, to each according to his need" was an early form of socialism, and it is why the Pilgrims were starving. Bradford writes that "young men that are most able and fit for labor and service" complained about being forced to "spend their time and strength to work for other men's wives and children." Also, "the strong, or man of parts, had no more in division of victuals and clothes, than he that was weak." So the young and strong refused to work and the total amount of food produced was never adequate.

To rectify this situation, in 1623 Bradford abolished socialism. He gave each household a parcel of land and told them they could keep what they produced, or trade it away as they saw fit. In other words, he replaced socialism with a free market, and that was the end of famines.

Many early groups of colonists set up socialist states, all with the same terrible results. At Jamestown, established in 1607, out of every shipload of settlers that arrived, less than half would survive their first twelve months in America. Most of the work was being done by only one-fifth of the men, the other four-fifths choosing to be parasites. In the winter of 1609-10, called "The Starving Time," the population fell from five-hundred to sixty.

Then the Jamestown colony was converted to a free market, and the results were every bit as dramatic as those at Plymouth. In 1614, Colony Secretary Ralph Hamor wrote that after the switch there was "plenty of food, which every man by his own industry may easily and doth procure." He said that when the socialist system had prevailed, "we reaped not so much corn from the labors of thirty men as three men have done for themselves now."

Before these free markets were established, the colonists had nothing for which to be thankful. They were in the same situation as Ethiopians are today, and for the same reasons. But after free markets were established, the resulting abundance was so dramatic that the annual Thanksgiving celebrations became common throughout the colonies, and in 1863, Thanksgiving became a national holiday.

Thus the real reason for Thanksgiving, deleted from the official story, is: Socialism does not work; the one and only source of abundance is free markets, and we thank God we live in a country where we can have them.

Tuesday, November 26, 2013

Wealth Flowing East

What will happen to the relative value of fiat currencies as not only production, but the anchor of wealth flows east? The debt denominated in those fiat currencies? The relative value of gold?

via Zerohedge

The last twenty years have seen an acceleration of real wealth transfer from the west to the east. Nowhere is that more evident than the change in gold stock piles since 1993 with Russia and China gorging and Holland, Belgium, and most notably Switzerland selling it all...

Chart: Goldman Sachs

via Zerohedge

The last twenty years have seen an acceleration of real wealth transfer from the west to the east. Nowhere is that more evident than the change in gold stock piles since 1993 with Russia and China gorging and Holland, Belgium, and most notably Switzerland selling it all...

Chart: Goldman Sachs

Do You Have Enough Gold/Yellen Dangerous For the Economy- Ron Paul

Outside of the yellow metal, Dr. Paul discusses how dangerous Janet Yellen is for the economy, placing the argument in terms of the often debunked Philips curve.

John Law and the Mississippi Bubble

The follies of money printing has been going on for a long, long time.

When Money Is Corrupted - Hidden Secrets Of Money 5

Maloney's continuing look at money, its history, and its present corruption. Remember, money is just a representation of what is produced. Anything action, rule, or event that divorces this relationship corrupts money.

Banks Set To Charge You For Holding (and Using) Your Money

Following on the FT.com article yesterday, the WSJ starts discussing what I think is probably one of the most glaring aspects and ramifications coming out of the Federal Reserve's October meeting, i.e. the potential cut in the interest rates bank receive for keeping reserves at the Federal Reserve. The banking industry was most vocal of the groups jumping on this possibility (and at some point inevitability), stating they may have to charge depositors for the 'privilege' of safeguarding and using their money.

We can argue the moral implications of such an act, but the more important complications of this is that any rational entity will just drain their deposits from the banking system. Not only could this strain banking balance sheets, as deposits are usually the lowest cost of funding (and just think, charging for deposits will essentially change an interest expense liability to a interest bearing asset), but will also increase the demand for money. If the demand for money increases, the game of monetary hot potato will get interesting in a hurry and we will not be talking about an ever decreasing velocity of money figure.

We can argue the moral implications of such an act, but the more important complications of this is that any rational entity will just drain their deposits from the banking system. Not only could this strain banking balance sheets, as deposits are usually the lowest cost of funding (and just think, charging for deposits will essentially change an interest expense liability to a interest bearing asset), but will also increase the demand for money. If the demand for money increases, the game of monetary hot potato will get interesting in a hurry and we will not be talking about an ever decreasing velocity of money figure.

A Whole Lotta Nothing- S&P 500 Price/Volume Heat Map for Nov. 25

As we approach the Thanksgiving holiday here in the US, we are likely to see price volatility and volume dry up. That is what I think we saw, in part, yesterday, as the S&P 500 closed down by about 10 basis points on day after trading up by about 20 or so basis points earlier in the trading session. The sector performance, as shown below, was mixed.

Ditto for the supply/demand dynamics. Largely outside of higher demand for healthcare stocks and increase supply in the telecom and utility names, the demand and supply appears balanced on the day.

Ditto for the supply/demand dynamics. Largely outside of higher demand for healthcare stocks and increase supply in the telecom and utility names, the demand and supply appears balanced on the day.

Ben's Rocket to Nowhere- Schiff

When reading this remember that the economy remains at stall speed (defined at year-over-year growth of 1.6% or less), employment levels are accelerating negatively, dividend cuts remains elevated, and investment less structures is far below the 10-year average and is in decline.

By Peter Schiff

Herd mentality can be as frustrating as it is inexplicable. Once a crowd starts moving, momentum can be all that matters and clear signs and warnings are often totally ignored. Financial markets are currently following this pattern with respect to the unshakable belief that the Federal Reserve is ready, willing, and most importantly, able, to immediately execute a wind down of its quantitative easing program. How this notion became so deeply entrenched is a mystery, but the stampede it has sparked is getting more violent, and irrational, by the day.

The release last week of the minutes of the October Fed policy meeting was a case study in dangerous collective delusion. Although the report did not contain a shred of hard information about the certainty or timing of a "tapering" campaign, most observers read into it definitive proof that the Fed would jump into action by December or March at the latest.

But while the Fed was gaining much attention by saying nothing, the Chinese made a blockbuster statement that was summarily ignored. Last week, a deputy governor of the People's Bank of China said that buying foreign exchange reserves was now no longer in China's national interest. The implication that China may no longer be accumulating U.S. government debt would amount to the "mother of all tapers" and could create a clear and present danger to the American economy. But the story barely rated a mention in the American media.

Instead, the current environment is all about the imminent Fed taper: the process of winding down the Fed's monthly purchases of $85 billion of treasury debt and mortgage-backed securities. However, the crowd fails to grasp that the Fed has embarked on an impossible mission. The herd is blissfully unaware that the Fed may not be able to reverse, or even slow, the course of QE without immediately sending the economy back into recession.

In an interview this week, outgoing Fed Chairman Ben Bernanke likened the QE program to the first stage in a multiple stage rocket that gets the spacecraft off the ground and accelerates it to the point where it is close to achieving permanent orbit. Like a first stage that has spent its fuel and has become dead weight, Bernanke seems to concede that QE is no longer capable of providing positive thrust, and as a result can now be jettisoned (like a first stage) so that the remainder of the spacecraft/economy can now move higher and faster. The Chairman's nifty metaphor provides some inspiring visuals, but is completely flawed in just about every way imaginable.

In real rocketry, when the first stage separates, it falls back to earth and is no longer a burden to the remainder of the ship. Subsequent booster rockets (which in economic terms Bernanke imagines would be continuation of zero interest rate policies) build on the gains made by the first stage. But the almost $4 trillion in assets that the Fed has accumulated as a result of the QE program will not simply vaporize into the stratosphere like a discarded rocket engine. In fact it will remain tethered to the rest of the economy with chains of solid lead.

In the process of accumulating the world's largest cache of Treasuries, the Fed has become the most important player in that market. I believe the Fed can't stop accumulating and dispose of its inventory without creating major market disruptions that will drag the economy down.

This would be true even if the economic rocket were actually approaching escape velocity. In reality, we are still sitting on the launch pad. By keeping interest rates far below market levels and by channeling newly created dollars directly into the financial markets, the QE program has resulted in major gains in the stock, real estate, and bond markets. Many have argued that all three are currently in bubble territory. Yet to the casual observer, these gains are proof of America's surging economic vitality.

But things look very different on Main Street, where the employment picture has not kept pace with the rising prices of financial assets. The work force participation rate continues to shrink (recently falling back to levels last seen in 1978),real wages have declined, and since the end of 2009 the temporary workforce has grown at a pace that is 14 times faster than those with permanent jobs. Americans are driving less, vacationing less, and switching to lower quality products and services in order to deal with falling purchasing power.

But the herd is closely watching the Fed's rocket show and does not understand that stocks and housing will likely fall, and bond yields rise steeply, once the QE is removed. The crowd is similarly ignoring the significance of the Chinese announcement.

Over the past decade or so, the People's Bank of China has been one of the largest buyers of U.S. Treasuries (after various U.S. government entities that are essentially nationalizing U.S. debt). China currently sits on $1 trillion or more in U.S. bond obligations.

So, just as many expect that the #1 buyer of Treasuries (the Fed) will soon begin paring back its purchases, the top foreign holder may cease buying, thereby opening a second front in the taper campaign. This should cause any level-headed observer to conclude that the market for such bonds will fall dramatically, causing severe upward pressure on interest rates. But the possibility is not widely discussed.

Also left out of the discussion is the degree to which remaining private demand for Treasuries is a function of the Fed's backstop (the Greenspan put, renewed by Bernanke, and expected to be maintained by Yellen). The ultra-low yields currently offered by long-term Treasuries are only acceptable to investors so long as the Fed removes the risk of significant price declines. If the private buyers, the Fed, China (and other central banks that may likely follow China's lead) refuse to buy Treasuries, who will take on the slack? Absent the Fed's backstop, prices will likely have to fall considerably to offer an acceptable risk/reward dynamic to investors. The problem is that any yield high enough to satisfy investors may be too high for the government or the economy to afford.

Little thought seems to be given to how the economy would react to 5% yields on 10 year Treasuries (a modest number in historical standards). The herd assumes that our stronger economy could handle such levels. In reality, 5% rates would likely deeply impact the financial sector, prick the bubbles in housing and stocks, blow a hole in the federal budget, and cause sizable losses in the value of the Fed's bond holdings. These developments would require the Fed to devise a rocket with even more power than the one it is now thinking of discarding.

That is why when it comes to tapering, the Fed is all bark and no bite. In fact, toward the end of last week, Dennis Lockhart, President of the Federal Reserve Bank of Atlanta, said that the Fed "won't taper its bond-buying until the economy is ready."He must know that the economy will never be ready. It's like a drug addict claiming that he'll stop using when he no longer needs them to stay high.

But the market understands none of this. Instead it is operating under dangerous delusions that are creating sky-high valuations for the latest social media craze, undermining the investment case for gold and other inflation hedges, and encouraging people to ignore growing risks that are hiding in plain sight.

This is not unusual in market history. When the spell is finally broken and markets wake up to reality, we will scratch our heads and wonder how we could ever have been so misguided.

By Peter Schiff

Herd mentality can be as frustrating as it is inexplicable. Once a crowd starts moving, momentum can be all that matters and clear signs and warnings are often totally ignored. Financial markets are currently following this pattern with respect to the unshakable belief that the Federal Reserve is ready, willing, and most importantly, able, to immediately execute a wind down of its quantitative easing program. How this notion became so deeply entrenched is a mystery, but the stampede it has sparked is getting more violent, and irrational, by the day.

The release last week of the minutes of the October Fed policy meeting was a case study in dangerous collective delusion. Although the report did not contain a shred of hard information about the certainty or timing of a "tapering" campaign, most observers read into it definitive proof that the Fed would jump into action by December or March at the latest.

But while the Fed was gaining much attention by saying nothing, the Chinese made a blockbuster statement that was summarily ignored. Last week, a deputy governor of the People's Bank of China said that buying foreign exchange reserves was now no longer in China's national interest. The implication that China may no longer be accumulating U.S. government debt would amount to the "mother of all tapers" and could create a clear and present danger to the American economy. But the story barely rated a mention in the American media.

Instead, the current environment is all about the imminent Fed taper: the process of winding down the Fed's monthly purchases of $85 billion of treasury debt and mortgage-backed securities. However, the crowd fails to grasp that the Fed has embarked on an impossible mission. The herd is blissfully unaware that the Fed may not be able to reverse, or even slow, the course of QE without immediately sending the economy back into recession.

In an interview this week, outgoing Fed Chairman Ben Bernanke likened the QE program to the first stage in a multiple stage rocket that gets the spacecraft off the ground and accelerates it to the point where it is close to achieving permanent orbit. Like a first stage that has spent its fuel and has become dead weight, Bernanke seems to concede that QE is no longer capable of providing positive thrust, and as a result can now be jettisoned (like a first stage) so that the remainder of the spacecraft/economy can now move higher and faster. The Chairman's nifty metaphor provides some inspiring visuals, but is completely flawed in just about every way imaginable.

In real rocketry, when the first stage separates, it falls back to earth and is no longer a burden to the remainder of the ship. Subsequent booster rockets (which in economic terms Bernanke imagines would be continuation of zero interest rate policies) build on the gains made by the first stage. But the almost $4 trillion in assets that the Fed has accumulated as a result of the QE program will not simply vaporize into the stratosphere like a discarded rocket engine. In fact it will remain tethered to the rest of the economy with chains of solid lead.

In the process of accumulating the world's largest cache of Treasuries, the Fed has become the most important player in that market. I believe the Fed can't stop accumulating and dispose of its inventory without creating major market disruptions that will drag the economy down.

This would be true even if the economic rocket were actually approaching escape velocity. In reality, we are still sitting on the launch pad. By keeping interest rates far below market levels and by channeling newly created dollars directly into the financial markets, the QE program has resulted in major gains in the stock, real estate, and bond markets. Many have argued that all three are currently in bubble territory. Yet to the casual observer, these gains are proof of America's surging economic vitality.

But things look very different on Main Street, where the employment picture has not kept pace with the rising prices of financial assets. The work force participation rate continues to shrink (recently falling back to levels last seen in 1978),real wages have declined, and since the end of 2009 the temporary workforce has grown at a pace that is 14 times faster than those with permanent jobs. Americans are driving less, vacationing less, and switching to lower quality products and services in order to deal with falling purchasing power.

But the herd is closely watching the Fed's rocket show and does not understand that stocks and housing will likely fall, and bond yields rise steeply, once the QE is removed. The crowd is similarly ignoring the significance of the Chinese announcement.

Over the past decade or so, the People's Bank of China has been one of the largest buyers of U.S. Treasuries (after various U.S. government entities that are essentially nationalizing U.S. debt). China currently sits on $1 trillion or more in U.S. bond obligations.

So, just as many expect that the #1 buyer of Treasuries (the Fed) will soon begin paring back its purchases, the top foreign holder may cease buying, thereby opening a second front in the taper campaign. This should cause any level-headed observer to conclude that the market for such bonds will fall dramatically, causing severe upward pressure on interest rates. But the possibility is not widely discussed.

Also left out of the discussion is the degree to which remaining private demand for Treasuries is a function of the Fed's backstop (the Greenspan put, renewed by Bernanke, and expected to be maintained by Yellen). The ultra-low yields currently offered by long-term Treasuries are only acceptable to investors so long as the Fed removes the risk of significant price declines. If the private buyers, the Fed, China (and other central banks that may likely follow China's lead) refuse to buy Treasuries, who will take on the slack? Absent the Fed's backstop, prices will likely have to fall considerably to offer an acceptable risk/reward dynamic to investors. The problem is that any yield high enough to satisfy investors may be too high for the government or the economy to afford.

Little thought seems to be given to how the economy would react to 5% yields on 10 year Treasuries (a modest number in historical standards). The herd assumes that our stronger economy could handle such levels. In reality, 5% rates would likely deeply impact the financial sector, prick the bubbles in housing and stocks, blow a hole in the federal budget, and cause sizable losses in the value of the Fed's bond holdings. These developments would require the Fed to devise a rocket with even more power than the one it is now thinking of discarding.

That is why when it comes to tapering, the Fed is all bark and no bite. In fact, toward the end of last week, Dennis Lockhart, President of the Federal Reserve Bank of Atlanta, said that the Fed "won't taper its bond-buying until the economy is ready."He must know that the economy will never be ready. It's like a drug addict claiming that he'll stop using when he no longer needs them to stay high.

But the market understands none of this. Instead it is operating under dangerous delusions that are creating sky-high valuations for the latest social media craze, undermining the investment case for gold and other inflation hedges, and encouraging people to ignore growing risks that are hiding in plain sight.

This is not unusual in market history. When the spell is finally broken and markets wake up to reality, we will scratch our heads and wonder how we could ever have been so misguided.

Be Contrarian, Gold Is Oversold- Frank Holmes

A Kitco News interview with US Global Investors CEO Frank Holmes

Monday, November 25, 2013

Greenspan Still Doesn’t Get It

Until recently, Alan Greenspan’s main argument to

exonerate himself of responsibility for the 2007-2009 financial crisis

has consisted in the claim that strong Asian demand for US treasury

bonds kept interest rates on mortgages unusually low. Though he has not

given up on this defense, he is now emphasizing a different tack, as

manifest in an article published in the current issue of Foreign Affairs. The article captures key themes elaborated in his latest book on the problem of forecasting, The Map and the Territory. His new tack is no better than the old tack.

Reprising what has lately become a very common refrain in financial commentary, Greenspan points the finger at the emotional side of human nature. This is the side where behavioral economics has recently made a name for itself in formulating its accounts of investor behaviour. Actually, this approach has a much older provenance, most famously conveyed in Keynes’ invocation of “animal spirits” in the General Theory of Employment, Interest, and Money. On the Keynesian view that behavioral economics adopts, investors do not buy and sell securities by rationally processing all available information and calculating expected returns. Rather, their decision making is distorted by cognitive biases and swayed by the oscillating passions of fear and hope.

In Greenspan’s rendering of the “animal spirits”, investors swing between phases of risk loving and aversion. Greenspan also maintains that “animal spirits” show themselves in herd behaviour. Inasmuch as investors take their cues from others, they tend to be either risk loving, or risk averse, all at the same time. You know where all this is going with respect to the financial crisis. According to Greenspan, the herd on Wall Street bought up mortgage backed securities while underestimating their risks, and then as soon as those risks became all too clear, everyone headed to the exits simultaneously.

No doubt, an understanding of human psychology is helpful in making sense of economic phenomena. But we have to be precise in distinguishing the role of psychology in economics. As Mises argued, economics is a deductive science. All its conclusions ultimately proceed from the axiom that human beings act by choosing between alternative means to realize their subjective ends. All the psychology that economics needs is the rather obvious proposition that an overriding goal of human beings is the quest to attain a more favorable state of affairs in their lives. Only when the attempt is made to illustrate the operation of economic principles in the real world, as happens when one is engaged in the writing of economic history, does psychology become illuminating. A psychological analysis might, for example, tell us what goals a particular individual or group are pursuing as well as the degree to which they prioritize considerations of the present over those of the future. Psychology can help economists tell richer stories; it cannot help them derive better economic theories.

Still, this is not the most significant of Greenspan’s errors. Yes, very few people are truly independent thinkers. Not being confident in any opinion unless it is socially confirmed somehow, people are inclined to think as others around them do. And so, yes, this means human beings are subject to herding behaviour. Yet in order for a herd to develop in favor of some opinion, such as that sub-prime mortgage securities are a great investment, that opinion must initially gain traction. This is what Greenspan’s account is missing. He seems to think that investor herds come out of nowhere, mysteriously emerging more often than would be expected from a bell curve distribution of asset price changes. How, in other words, did sub-prime mortgage trend higher in the first place so as to generate all the enthusiasm it subsequently attracted?

The answer, of course, involves the loose monetary policy that Greenspan himself ran in the 2000′s as chairman of the Federal Reserve. By injecting so much money into the financial system, he supplied market participants with the means of raising the demand for financial assets. By greatly reducing the yields on low risk government bonds, Greenspan shifted that demand towards higher risk mortgage securities offering more appealing rates of return. Yield spreads narrowed between private sector and government bonds.

Concomitantly, there was a steady upward movement in the prices of mortgage bonds, which the “animal spirits” then exacerbated through investor herding.

So if Greenspan hadn’t run an easy money policy in the first place, there would have been nothing in the mortgage arena for the “animal spirits” to have latched onto. This is always the case with financial asset bubbles. Excess hope only comes into play after the central bank has set the boom in motion. Excess fear is the inevitable follow-up once the bubble is popped.

Ironically enough, we can appeal to psychology to explain why Greenspan is unable to recognize this point. Human beings are strongly inclined to maintain their self-esteem. Admitting your own complicity in one of history’s greatest financial crises goes against that fundamental drive. Greenspan would be well advised to apply psychology not just to others, but to himself.

Reprising what has lately become a very common refrain in financial commentary, Greenspan points the finger at the emotional side of human nature. This is the side where behavioral economics has recently made a name for itself in formulating its accounts of investor behaviour. Actually, this approach has a much older provenance, most famously conveyed in Keynes’ invocation of “animal spirits” in the General Theory of Employment, Interest, and Money. On the Keynesian view that behavioral economics adopts, investors do not buy and sell securities by rationally processing all available information and calculating expected returns. Rather, their decision making is distorted by cognitive biases and swayed by the oscillating passions of fear and hope.

In Greenspan’s rendering of the “animal spirits”, investors swing between phases of risk loving and aversion. Greenspan also maintains that “animal spirits” show themselves in herd behaviour. Inasmuch as investors take their cues from others, they tend to be either risk loving, or risk averse, all at the same time. You know where all this is going with respect to the financial crisis. According to Greenspan, the herd on Wall Street bought up mortgage backed securities while underestimating their risks, and then as soon as those risks became all too clear, everyone headed to the exits simultaneously.

No doubt, an understanding of human psychology is helpful in making sense of economic phenomena. But we have to be precise in distinguishing the role of psychology in economics. As Mises argued, economics is a deductive science. All its conclusions ultimately proceed from the axiom that human beings act by choosing between alternative means to realize their subjective ends. All the psychology that economics needs is the rather obvious proposition that an overriding goal of human beings is the quest to attain a more favorable state of affairs in their lives. Only when the attempt is made to illustrate the operation of economic principles in the real world, as happens when one is engaged in the writing of economic history, does psychology become illuminating. A psychological analysis might, for example, tell us what goals a particular individual or group are pursuing as well as the degree to which they prioritize considerations of the present over those of the future. Psychology can help economists tell richer stories; it cannot help them derive better economic theories.

Still, this is not the most significant of Greenspan’s errors. Yes, very few people are truly independent thinkers. Not being confident in any opinion unless it is socially confirmed somehow, people are inclined to think as others around them do. And so, yes, this means human beings are subject to herding behaviour. Yet in order for a herd to develop in favor of some opinion, such as that sub-prime mortgage securities are a great investment, that opinion must initially gain traction. This is what Greenspan’s account is missing. He seems to think that investor herds come out of nowhere, mysteriously emerging more often than would be expected from a bell curve distribution of asset price changes. How, in other words, did sub-prime mortgage trend higher in the first place so as to generate all the enthusiasm it subsequently attracted?

The answer, of course, involves the loose monetary policy that Greenspan himself ran in the 2000′s as chairman of the Federal Reserve. By injecting so much money into the financial system, he supplied market participants with the means of raising the demand for financial assets. By greatly reducing the yields on low risk government bonds, Greenspan shifted that demand towards higher risk mortgage securities offering more appealing rates of return. Yield spreads narrowed between private sector and government bonds.

Concomitantly, there was a steady upward movement in the prices of mortgage bonds, which the “animal spirits” then exacerbated through investor herding.

So if Greenspan hadn’t run an easy money policy in the first place, there would have been nothing in the mortgage arena for the “animal spirits” to have latched onto. This is always the case with financial asset bubbles. Excess hope only comes into play after the central bank has set the boom in motion. Excess fear is the inevitable follow-up once the bubble is popped.

Ironically enough, we can appeal to psychology to explain why Greenspan is unable to recognize this point. Human beings are strongly inclined to maintain their self-esteem. Admitting your own complicity in one of history’s greatest financial crises goes against that fundamental drive. Greenspan would be well advised to apply psychology not just to others, but to himself.

Tomas Salamanca is a Canadian Scholar.

No Easy Fed Exit

When reading the below, remember that the monetary per unit of GDP is running at multiples above the long-term average and that any normalization process will come at a significant cost.

Via Phoenix Capital Research and Zerohedge

The primary theme driving US stock markets, is that of whether the Fed will taper or not.

The mere fact that this is the single most important theme for the markets goes a long way towards explaining how busted our financial system has become. Before 2007, the talk concerned whether the Fed would change interest rates. Today we talk about whether scaling back from $85 billion in asset purchases per month represents tightening.”

At the end of the day, the fact is that the Fed can never exit its strategies. I realize there are a lot of smart people with smart explanations for why the Fed can exit, but they are missing a critical component: human nature.

We saw this in real-time back in May 2013 when the Fed first floated the idea of tapering its QE programs. The Fed had hoped it could float this idea and let the markets get used to it, instead interest rates spiked with rates on the 10-year moving up from 1.5% to nearly 3% in a matter of weeks.

At the time, the financial media began to write articles about the market’s “taper tantrum” as though metaphorically aligning the capital markets with s spoiled brat explained the reaction.

The Fed then did a 180 despite all but promising it would taper QE. Bernanke even went so far as to negate the call for a taper in his July Q&A.

Why did he do this? It’s simple. He like the rest of the Fed saw in simple terms that there is no such thing as a smooth exit. The market rebelled at the mere hint of tapering at a time when the Fed is buying $85 billion per month. If the Fed were to actually go ahead and taper what would rates do?

Moreover, with the financial system now even more leveraged than it was going into 2007… what would happen if interest rates moved back to their historical averages of 4% on the ten year Treasury?

Ka-Boom.

So now, there is talk of the Fed tapering in December. Maybe it will, maybe it won’t. I have no idea. No one does. If we were going to try to analyze the Fed’s moves via logic or economic fundamentals, we would have tapered months if not years ago.

Instead we’ll get more of the same: talk of taper to talk the markets down, then a surprise decision to not taper so market take off again. The Fed is now managing expectations more than anything. The Fed has acted in 90+% of the months since the Crisis began. This tells us precisely what the game plan is going forward.

At some point, and I cannot say when, this whole mess will come unhinged. When it does 2008 will look like a joke.

Via Phoenix Capital Research and Zerohedge

The primary theme driving US stock markets, is that of whether the Fed will taper or not.

The mere fact that this is the single most important theme for the markets goes a long way towards explaining how busted our financial system has become. Before 2007, the talk concerned whether the Fed would change interest rates. Today we talk about whether scaling back from $85 billion in asset purchases per month represents tightening.”

At the end of the day, the fact is that the Fed can never exit its strategies. I realize there are a lot of smart people with smart explanations for why the Fed can exit, but they are missing a critical component: human nature.

We saw this in real-time back in May 2013 when the Fed first floated the idea of tapering its QE programs. The Fed had hoped it could float this idea and let the markets get used to it, instead interest rates spiked with rates on the 10-year moving up from 1.5% to nearly 3% in a matter of weeks.

At the time, the financial media began to write articles about the market’s “taper tantrum” as though metaphorically aligning the capital markets with s spoiled brat explained the reaction.

The Fed then did a 180 despite all but promising it would taper QE. Bernanke even went so far as to negate the call for a taper in his July Q&A.

Why did he do this? It’s simple. He like the rest of the Fed saw in simple terms that there is no such thing as a smooth exit. The market rebelled at the mere hint of tapering at a time when the Fed is buying $85 billion per month. If the Fed were to actually go ahead and taper what would rates do?

Moreover, with the financial system now even more leveraged than it was going into 2007… what would happen if interest rates moved back to their historical averages of 4% on the ten year Treasury?

Ka-Boom.

So now, there is talk of the Fed tapering in December. Maybe it will, maybe it won’t. I have no idea. No one does. If we were going to try to analyze the Fed’s moves via logic or economic fundamentals, we would have tapered months if not years ago.

Instead we’ll get more of the same: talk of taper to talk the markets down, then a surprise decision to not taper so market take off again. The Fed is now managing expectations more than anything. The Fed has acted in 90+% of the months since the Crisis began. This tells us precisely what the game plan is going forward.

At some point, and I cannot say when, this whole mess will come unhinged. When it does 2008 will look like a joke.

The Problems with Keynesian Solutions to the Current Depression

Another lecture by Robert Murphy from the Mises Institute.

Contributions of Mises and Rothbard to Economic Thought

A lecture given by Robert Murphy at the Mises Institute.

High Prices Beget Higher Prices- Price/Volume Heat Map for Nov. 22

It should probably go without saying that I remain bearish overall. The economy remains weak, profit margins are abnormally high, and the investment/economic environment continue to be manipulated by the Federal Reserve's money printing/bond buying train. That said, it has been my observation that higher prices beget higher prices and the S&P 500 closing at an all-time high- following the Dow Jones- suggests equity prices will continue to trend higher. For how long is anyone's guess, as overall volume levels remains subdued and demand (as evidenced by the price/volume heat maps below) has become mixed. With that said, I would not expect us to get any definitive answers in this week's trading, considering the Thanksgiving holiday in the US.

Looking at the latest daily heat map, we are seeing a few divergences. For instance, the discretionary price performance versus demand.

Week Ending Nov. 22

For the latest ended week, the S&P 500 closed marginally higher, but it was enough to push the index to all time highs.

That said, demand appears weak overall and the weekly performance was limited in scope.

Looking at the latest daily heat map, we are seeing a few divergences. For instance, the discretionary price performance versus demand.

Week Ending Nov. 22

For the latest ended week, the S&P 500 closed marginally higher, but it was enough to push the index to all time highs.

That said, demand appears weak overall and the weekly performance was limited in scope.

A Glimpse of the Monetary Hot Potato- A Fee on Your Deposits

As I showed here, Mises described the three step process in which money printing can (at least in the first step) lead to a lower velocity of money, as the demand for money increases, helping maintain the purchasing power of the dollar. Moving into the second and third step would take some event or series events that would cause businesses and individuals to decrease their demand to hold money.

We may have just seen the first signs that these later phases are closer than many believe or understand. In the latest Fed minutes from the October meeting, the Federal Reserve board openly discussed the idea of cutting the interest rates on reserves kept with the Fed that it pays to the banking system. As most investors and the media fawned all over the idea of taper occurring sooner rather than later, this announcement was largely ignored. More so and in response a number of banking concerns discussed charging depositors a fee for deposits kept by the banks. This is discussed here in an article by the FT.com

Depositors already have to cope with near-zero interest rates, but

paying just to leave money in the bank would be highly unusual and

unwelcome for companies and households.

The warning by bank executives highlights the dangers of one strategy the Fed could use to offset an eventual “tapering” of the $85bn a month in asset purchases that have fuelled global financial markets for the last year.

Banks say they may have to charge because taking in deposits is not free: they have to pay premiums of a few basis points to a US government insurance programme.

“Right now you can at least break even from a revenue perspective,” said one executive, adding that a rate cut by the Fed “would turn it into negative revenue – banks would be disincentivised to take deposits and potentially charge for them”.

Other bankers said that a move to negative rates would not only trim margins but could backfire for banks and the system as a whole, as it would incentivise treasury managers to find higher-yielding, riskier assets.

“It’s not as if we are suddenly going to start lending to [small and medium-sized enterprises],” said one. “There really isn’t the level of demand, so the danger is that banks are pushed into riskier assets to find yield.”

The danger of negative rates has deterred the Fed from cutting interest on bank reserves in the past. If it were to do so now, it would most probably expand a new facility that lets banks and money market funds deposit cash at a small, positive interest rate. That should avoid any need for banks to charge depositors.

About half of the reserves come from non-US banks that do not have to pay the deposit insurance fee. Their favourite manoeuvre is to take deposits from money market funds and park them overnight at the Fed, earning millions of dollars risk-free. Cutting the interest on reserves would stop that.

Lowering interest on reserves would also affect money market funds, said Alex Roever, head of US interest rate strategy at JPMorgan.

“[It] would decrease the incentive for those banks to borrow in the money markets, which in turn could leave money market funds short of certain investments and force them to bid up the price of their next best options,” he said.

Richard Gilhooly, strategist at TD Securities, highlighted some benefits to the Fed from the possible cut: “[It] would not only anchor short-term rates near zero, it also stands to boost the profits for the Fed as they pay less interest to banks,” he said.

Have no doubt, a reduction in the interest rates banks receive for holding reserves at the Fed will reduce the amount of reserves banks are holding on their balance sheets. Additionally, a fee on deposits will likely lead to businesses and individuals draining their saving deposits from banks, reducing the demand to hold money and increasing the velocity of money.

Although it remains uncertain if the Fed will cut rates on reserves or banks will start fees on deposits, this is a road sign to watch.

We may have just seen the first signs that these later phases are closer than many believe or understand. In the latest Fed minutes from the October meeting, the Federal Reserve board openly discussed the idea of cutting the interest rates on reserves kept with the Fed that it pays to the banking system. As most investors and the media fawned all over the idea of taper occurring sooner rather than later, this announcement was largely ignored. More so and in response a number of banking concerns discussed charging depositors a fee for deposits kept by the banks. This is discussed here in an article by the FT.com

Leading US banks have warned that they could start charging companies and consumers for deposits if the US Federal Reserve cuts the interest it pays on bank reserves.

The warning by bank executives highlights the dangers of one strategy the Fed could use to offset an eventual “tapering” of the $85bn a month in asset purchases that have fuelled global financial markets for the last year.

Minutes of the Fed’s October meeting

published last week showed it was heading towards a taper in the coming

months – perhaps as soon as December – but wants to find a different

way to add stimulus at the same time. “Most” officials thought a cut in

the interest on bank reserves was an option worth considering.

Executives at two of the top five US banks said a cut in the 0.25 per

cent rate of interest on the $2.4tn in reserves they hold at the Fed

would lead them to pass on the cost to depositors.Banks say they may have to charge because taking in deposits is not free: they have to pay premiums of a few basis points to a US government insurance programme.

“Right now you can at least break even from a revenue perspective,” said one executive, adding that a rate cut by the Fed “would turn it into negative revenue – banks would be disincentivised to take deposits and potentially charge for them”.

Other bankers said that a move to negative rates would not only trim margins but could backfire for banks and the system as a whole, as it would incentivise treasury managers to find higher-yielding, riskier assets.

“It’s not as if we are suddenly going to start lending to [small and medium-sized enterprises],” said one. “There really isn’t the level of demand, so the danger is that banks are pushed into riskier assets to find yield.”

The danger of negative rates has deterred the Fed from cutting interest on bank reserves in the past. If it were to do so now, it would most probably expand a new facility that lets banks and money market funds deposit cash at a small, positive interest rate. That should avoid any need for banks to charge depositors.

About half of the reserves come from non-US banks that do not have to pay the deposit insurance fee. Their favourite manoeuvre is to take deposits from money market funds and park them overnight at the Fed, earning millions of dollars risk-free. Cutting the interest on reserves would stop that.

Lowering interest on reserves would also affect money market funds, said Alex Roever, head of US interest rate strategy at JPMorgan.

“[It] would decrease the incentive for those banks to borrow in the money markets, which in turn could leave money market funds short of certain investments and force them to bid up the price of their next best options,” he said.

Richard Gilhooly, strategist at TD Securities, highlighted some benefits to the Fed from the possible cut: “[It] would not only anchor short-term rates near zero, it also stands to boost the profits for the Fed as they pay less interest to banks,” he said.

Have no doubt, a reduction in the interest rates banks receive for holding reserves at the Fed will reduce the amount of reserves banks are holding on their balance sheets. Additionally, a fee on deposits will likely lead to businesses and individuals draining their saving deposits from banks, reducing the demand to hold money and increasing the velocity of money.

Although it remains uncertain if the Fed will cut rates on reserves or banks will start fees on deposits, this is a road sign to watch.

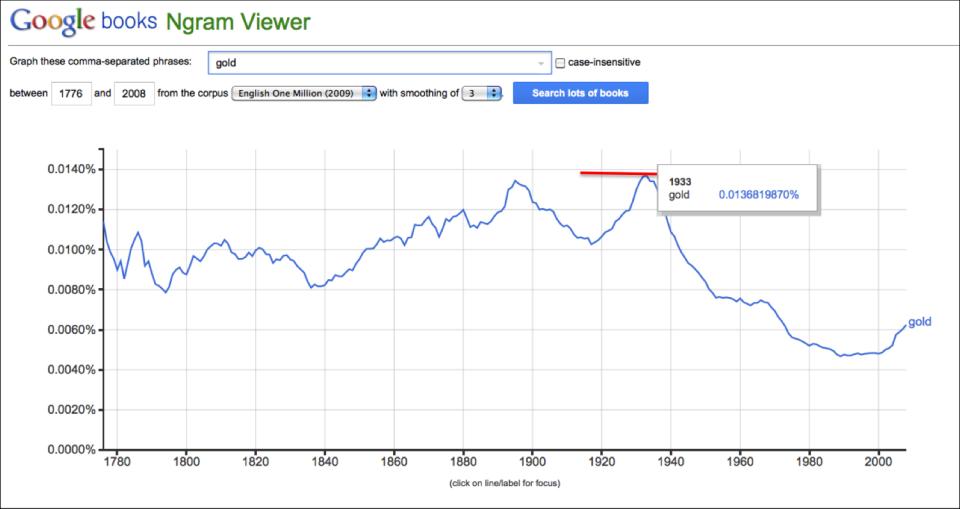

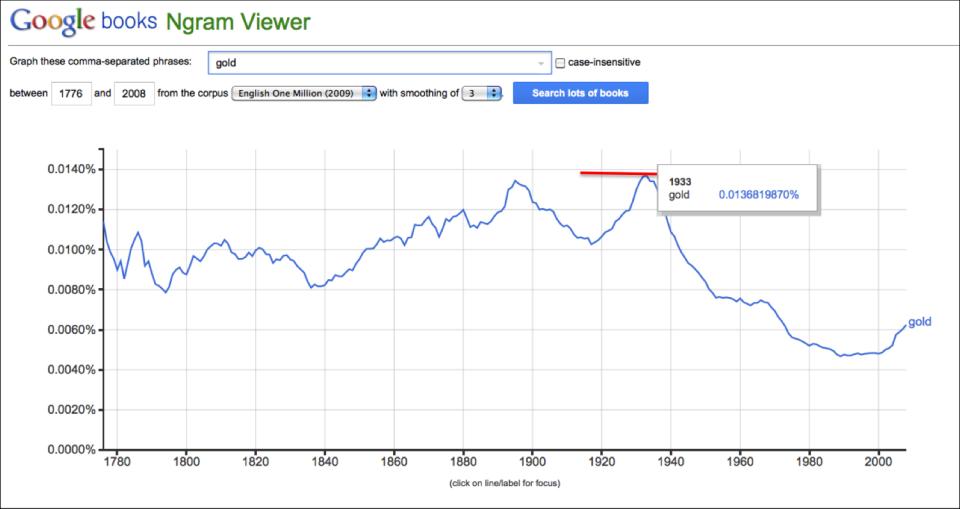

'Gold' In the English Language

I don't believe this means anything in an investment sense over some short or medium term investment horizon but worth considering nonetheless.

Via Simon Black's Sovereign Man Blog

In George Orwell's seminal work 1984, there's a really great scene early in the book between Winston (the main character) and Syme, a low-level functionary at the Ministry of Truth.

Syme is working on the 11th Edition of the Newspeak Dictionary, and he explains to Winston how the Ministry of Truth is actually removing words from the English vocabulary.

In Newspeak, words like freedom have been struck from the dictionary altogether, to the point that the mere concept of liberty would be incommunicable in the future.

I thought about this scene recently as I was testing out Google's new Ngram Viewer tool.

If you haven't seen it yet, Google has digitized over a million books that were printed as far back as 1500, and they've made the contents searchable within their own database.

The Ngram Viewer allows you to search for particular keywords. And you can see over time how prevalent the search terms were for particular years.

Out of curiosity, I searched for the term "gold" in English language books starting in 1776.

As one would expect back in the 18th and 19th centuries when gold was actually considered money, the instances of the word 'gold' favored prevalently in English language books at the time.

The trend continued into the early part of the 20th century.

But then something interesting happened in the mid-1930s. The use of the word 'gold' in English language books reached its peak... and began a steep, multi-decade decline.

Further investigation shows that the peak actually occurred in 1933. And as any student of gold in modern history knows, 1933 was the same year that the President of the United States (FDR) criminalized the private ownership of gold.

It remained this way for four decades. And by the time Gerald Ford repealed the prohibition on gold ownership, the concept of gold being money had been permanently struck from the American psyche, just as the Orwellian Newspeak dictionary had done.

By the mid-1970s (and through today), people have become readily accepting of the idea that money was nothing more than pieces of paper conjured at will by central bankers.

The good news is that, according to Google's data, there seems to be slight uptick in the number of instances of the word 'gold' in English language books over the last 10-years or so.

No doubt, this probably has a lot to do with gold's seemingly interminable rise relative to paper currency.

One can hope that the trend will hold... that more people will wake up to the reality that the central-bank controlled fiat currency system is a total fraud.

Via Simon Black's Sovereign Man Blog

In George Orwell's seminal work 1984, there's a really great scene early in the book between Winston (the main character) and Syme, a low-level functionary at the Ministry of Truth.

Syme is working on the 11th Edition of the Newspeak Dictionary, and he explains to Winston how the Ministry of Truth is actually removing words from the English vocabulary.

In Newspeak, words like freedom have been struck from the dictionary altogether, to the point that the mere concept of liberty would be incommunicable in the future.

I thought about this scene recently as I was testing out Google's new Ngram Viewer tool.

If you haven't seen it yet, Google has digitized over a million books that were printed as far back as 1500, and they've made the contents searchable within their own database.

The Ngram Viewer allows you to search for particular keywords. And you can see over time how prevalent the search terms were for particular years.

Out of curiosity, I searched for the term "gold" in English language books starting in 1776.

As one would expect back in the 18th and 19th centuries when gold was actually considered money, the instances of the word 'gold' favored prevalently in English language books at the time.

The trend continued into the early part of the 20th century.

But then something interesting happened in the mid-1930s. The use of the word 'gold' in English language books reached its peak... and began a steep, multi-decade decline.

Further investigation shows that the peak actually occurred in 1933. And as any student of gold in modern history knows, 1933 was the same year that the President of the United States (FDR) criminalized the private ownership of gold.

It remained this way for four decades. And by the time Gerald Ford repealed the prohibition on gold ownership, the concept of gold being money had been permanently struck from the American psyche, just as the Orwellian Newspeak dictionary had done.

By the mid-1970s (and through today), people have become readily accepting of the idea that money was nothing more than pieces of paper conjured at will by central bankers.

The good news is that, according to Google's data, there seems to be slight uptick in the number of instances of the word 'gold' in English language books over the last 10-years or so.

No doubt, this probably has a lot to do with gold's seemingly interminable rise relative to paper currency.

One can hope that the trend will hold... that more people will wake up to the reality that the central-bank controlled fiat currency system is a total fraud.

Until next week,

Simon Black

Simon Black

Subscribe to:

Comments (Atom)