As you probably know, the BEA released their second estimate on fourth quarter GDP earlier this morning. Growth was revised up to 0.1% annualized rate from a -0.1% decline stated in the advanced estimate. Additionally, the year-on-year growth rate went to 1.6% from 1.5%. Essentially, the GDP estimates were unchanged. More importantly and in my opinion, the figures still suggest that GDP is at or near stall speed and that recessionary condition risks are elevated.

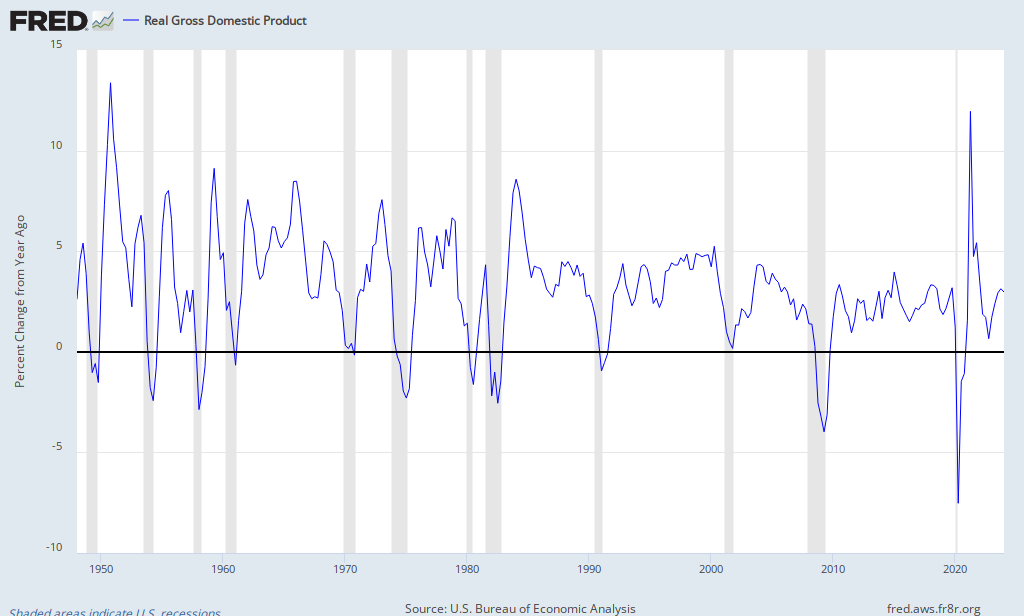

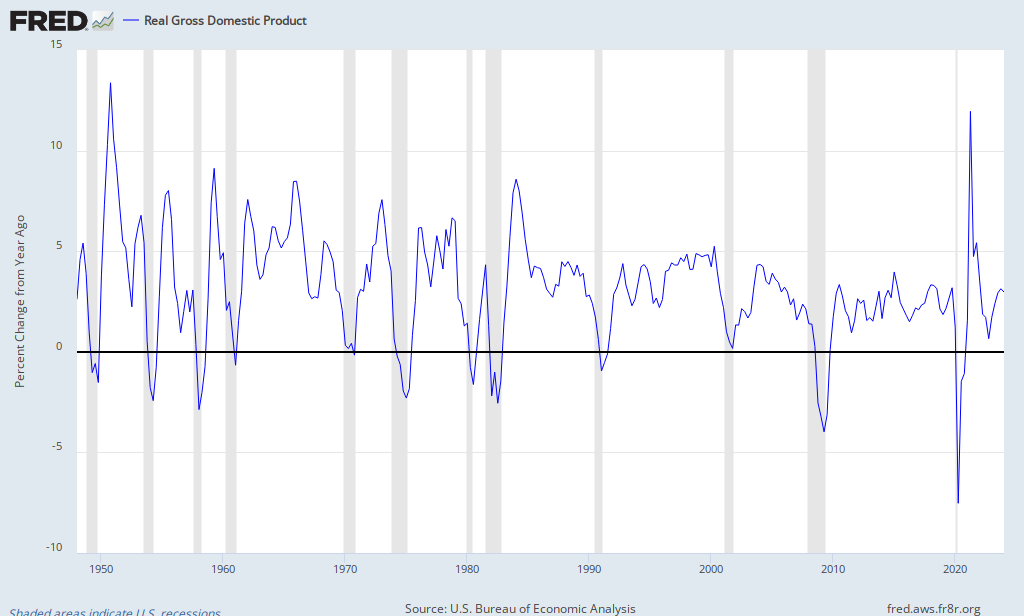

As you can in the chart below (via. the St Louis Fed), year-over-year GDP growth around 1.5% has typically preceded an outright contraction in the economy. This is especially true in regards with the directional change in GDP prior to the observation.

As you can in the chart below (via. the St Louis Fed), year-over-year GDP growth around 1.5% has typically preceded an outright contraction in the economy. This is especially true in regards with the directional change in GDP prior to the observation.

Turning to the revisions, the positive revision of 0.1% in year-over- growth really does make a difference in the historical context, as it pertains to recessionary risks. I had described in prior posts that stall speed GDP was pegged at a rate of 1.5% or less, predominantly based on comments from Art Cashin, and created models that calculated historical forward GDP growth figures that bore this out. Following this morning's upward revision however, I reran the models inputting the 1.6% rate versus the 1.5% previously.

Low and behold, the revision really made no difference and it still appears we remain at stall speed. The historical two quarter median change in GDP was a -0.7% following periods when a contraction in GDP growth figured its was down to 1.6% or less. This compares to a total population median GDP growth of 3.1%. Additionally, GDP tends to show growth in most quarters, expanding roughly 88% of all quarters since the early 1940's. This compares to a batting average of less than 50% when GDP has fallen to stall speed.

Although the historical context may not completely describe our current condition, I think it does suggest that recessional risks are higher than most assume.

No comments:

Post a Comment