As a

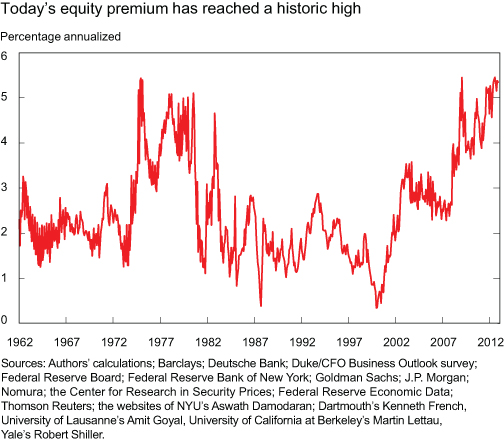

follow up to my post about the lunacy in the Fed's equity risk premium/the market is undervalued analysis, John Hussman of Hussman Funds says it best in his weekly column...

The

total capitalization of the U.S. stock market is presently about $17

trillion (about $16.2 trillion as non-financials). The Federal Reserve

is purchasing $85 billion of Treasury and mortgage-backed bonds each

month. This creates a pool of bank reserves that have to be held by someone at

each point in time, until those reserves are retired. This

zero-interest cash is a hot potato that certainly creates speculative

demand. But it is thesuperstitious aspect

of the belief in QE – as if it has some inexplicable power to remove

downside risk – that deserves just as much credit for the recent

advance. It is the superstition that QE mysteriously removes economic risk, and the psychological discomfort of

low interest rates far beyond its true effect on investment value, that

has encouraged investors to abandon their demand for a risk premium to

adequately compensate them for the risk they are taking.

How

can we know that? Simple. We can demonstrate that QE is not exerting

the bulk of its effects through cash flows or the effect of lower

interest rates on earnings or present discounted value. This leaves the

suppression ofrisk premiums as the remaining and primary effect of QE. In other words, QE has not increased the value of equities. It has only increased the price, but that increase in price has no significant fundamental underpinning.

To

see this, first consider cash flows. Imagine that instead of attempting

to boost stock prices indirectly through quantitative easing, the Fed

took the candy-land approach of literally handing the $85 billion directly to

stockholders to reward them for owning stocks. How much would that

direct cash distribution benefit a stock market with a $17 trillion

market capitalization? Do the arithmetic. Only 0.5% a month. Yet

investors have chased prices at a far more rapid pace as a result of

quantitative easing. Remember, of course, that the Fed is not in fact

distributing cash to shareholders.

What

about the benefit of lower interest rates? Domestic nonfinancial

corporate debt is presently $8.6 trillion. Even a 4% reduction in

interest rates (400 basis points) comes to $344 billion a year. Assume

that benefit accrues strictly to publicly traded companies, and extend

that benefit over 5 years. It’s still only worth 10% of market

capitalization. As a side note, lower interest rates also suppress

income from corporate investments, particularly with large amounts of

cash on corporate balance sheets. And though it has become a fad to

subtract out cash from market capitalization, it is a profoundly

incorrect fad. If it was correct, a company with a billion dollars of

market cap could issue a billion dollars of debt, hold the proceeds in

cash, and the stock could be considered "free."

What

about higher GDP leading to greater profits and supporting stocks that

way? Take the current ratio of corporate profits/GDP of 11% at face

value (even though that share is 70% above the historical norm), and

let’s even assume that all of these profits go to corporations with

publicly traded stocks. How much would GDP have to rise, sustained over 5

years, to justify even a 10% increase in market capitalization? The

required amount of additional GDP is 1.7 trillion / 0.11, or $15.5

trillion, or about $3.1 trillion a year sustained over 5 years. The

present size of the U.S. economy is about $16 trillion. So yes, if QE

could boost the size of the U.S. economy by about 20% and sustain it

over 5 years, and the additional earnings could be delivered entirely to

stock market investors in cash, it would justify a 10% increase in

market capitalization.

Here’s

one for geeks: What about the effect of a lower capitalization rate on

discounted future cash flows? Simple. Take a given initial cash

distribution and assume 6% annual growth, which is about the long-term

peak-to-peak growth rate of earnings and nominal GDP over the economic

cycle. Discount those cash flows annually into the indefinite future.

Now drop the discount rate by about 4% (400 basis points) for 5 years.

Even 10 years. Try 15. How much does the present discounted value

increase? Not much – about 5-15% depending on your initial discount rate

and how long you sustain the change.

We’ve

certainly seen people correlate the monetary base with the S&P 500

since 2009, ignoring that two rising lines will always have a

correlation of over 90%, and inferring targets for the S&P based on

assumptions about base money. But this is little more than extrapolation

based on statistical misuse. It may very well be that the promise of

more QE will produce a reflexive pursuit of stocks in the same

direction, but investors should at least be aware that this pursuit has

no fundamental basis, and rests purely on the willingness of investors

to abandon any need to be compensated for risk.

What

concerns me most here is the lack of effort that investors are taking

to analyze and quantify the mechanism by which quantitative easing

should work, beyond a vague superstition that “it just does.” The notes I

receive suggesting that somehow QE makes all historical economic

relationships, profit margin dynamics, and financial relationships

irrelevant remind me of some remarks that appeared in Business Week:

“During

every preceding period of stock speculation and subsequent collapse

there has been the same widespread idea that in some miraculous way,

endlessly elaborated but never actually defined, the fundamental

conditions and requirements of progress and prosperity have been

changed, that old economic principles have been abrogated, that all

economic problems have been solved, that industry has suddenly become

more efficient than it ever was before … that business profits are

destined to grow faster and without limit, and that the expansion of

credit can have no end.”

Those remarks unfortunately waited to appear until November 1929.

In short, there is no transmission mechanism by which QE has any large and beneficial effect on the value of equities. There has certainly been an effect on price – but this effect is driven by the

willingness of investors to abandon their demand for a risk premium

that will actually compensate them for the risk they are taking.

Sounds more like the equity risk premium is a lot lower than 5% to 6%.