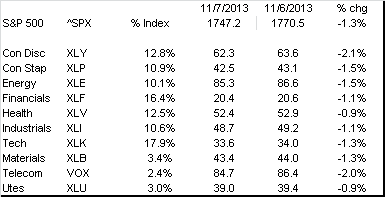

Traders I have been listening to have been discussing the possibility that operators were holdings up the market ahead of the Twitter IPO, as to launch the company into a stronger market. Boy do they appear correct. Not only did we see a sell off, but the sell accelerated throughout the trading day yesterday, with the market essentially closing at its lows on higher than average volume levels. All in, the S&P 500 fell by about 130 basis points with all sectors experiencing losses.

As you might expect, the price/volume heat map is a virtual sea of red. Demand looks almost nonexistent. I will not go into any deep exploratory commentary here, but as I noted demand has been weak for days, despite continued market gains. Supply appears to have come back with a vengeance. We will have to see if it starts a new trend.

As you might expect, the price/volume heat map is a virtual sea of red. Demand looks almost nonexistent. I will not go into any deep exploratory commentary here, but as I noted demand has been weak for days, despite continued market gains. Supply appears to have come back with a vengeance. We will have to see if it starts a new trend.

No comments:

Post a Comment