A few making new highs on volume. Strangely enough, CAMP was up after announcing a secondary offering of stock, interesting. CNO reported Q4 results, but also announced the tender offer of convert notes. Shares of HERO were up marginally on better quarterly results, but volume levels were impressive at nearly 3x average. KORS shares were also up after reporting better quarterly results. The healthcare REIT, OHI reported quarterly results that the Street apparently like. i also think the nearly 7% yield helped spark some interest from income hungry investors. Ihe building supplier MAS jumped nearly 13% as management forecast strong housing starts in 2013. Finally, SJM was up a little on heavy volume as the company caught an upgrade from some investment house.

Tuesday, February 12, 2013

Volume Off the High Feb 12th Edtion

Jumping right in here...... Despite a beat on the top line, HUN reported a quarterly loss, sending shares lower. Another company reporting earnings was TGH, beating estimates but missing on revenue. And yet another company reporting earnings, KVHI reported a decent quarter, but guided lower. Lastly, VAL also reported earnings with results missing expectations.

On Great Manias

After reading this I am reminded what Rothbard stated in at least one of his speeches- the depression is the recovery.....

An excerpt from the Martin Conrad piece in this week's Barron's

The Great Mania

Reinflating the collapsed housing bubble, as many desire, would likely yield the same disastrous result. What's needed are lower, fairer prices, and more investment in more productive sectors of the economy.

Manias occur for many reasons, but great manias are made possible and sustained by errant government policies that may seem to have good reasons, none of them with any long-term economic value.

Housing, despite high leverage, high transaction costs, and poor liquidity, was promoted as a dream investment for everyone. Massive intervention in this market by populist government policies and agencies fostering affordability exacerbated these normal defects and disastrously distorted the market. It was a "dream," in the sense of confused, wishful thinking. But to think and act this way with many trillions of dollars, most of it borrowed, was irresponsible on an historic scale.

There is now much media commentary that no sustained and robust recovery is possible until the housing sector recovers (that is, until house prices rise again). This desire to simply reinflate the collapsed bubble would likely yield the same disastrous result again. Another course would likely be more effective: restructuring away from so much dependence on leveraged, expensive, and speculative housing values. We should no more regret the demise of expensive housing than we should the decline of expensive oil, both of which are poorly correlated with productive, sustainable economic growth, but strongly correlated with damaging inflation.

Disciplined buyers -- too long unfairly disadvantaged by government policies -- are now sitting on trillions in savings that are earning, doing, and financing nothing. This money could clear the housing market, but only at lower, fairer prices. That would finally be "affordable housing."

Manias begin in obscurity and pessimism, rise with confidence and imitation, reach a state of euphoria and finally end in tragedy. They often change history in ways that are not foreseeable.

An excerpt from the Martin Conrad piece in this week's Barron's

The Great Mania

Reinflating the collapsed housing bubble, as many desire, would likely yield the same disastrous result. What's needed are lower, fairer prices, and more investment in more productive sectors of the economy.

Manias occur for many reasons, but great manias are made possible and sustained by errant government policies that may seem to have good reasons, none of them with any long-term economic value.

Housing, despite high leverage, high transaction costs, and poor liquidity, was promoted as a dream investment for everyone. Massive intervention in this market by populist government policies and agencies fostering affordability exacerbated these normal defects and disastrously distorted the market. It was a "dream," in the sense of confused, wishful thinking. But to think and act this way with many trillions of dollars, most of it borrowed, was irresponsible on an historic scale.

There is now much media commentary that no sustained and robust recovery is possible until the housing sector recovers (that is, until house prices rise again). This desire to simply reinflate the collapsed bubble would likely yield the same disastrous result again. Another course would likely be more effective: restructuring away from so much dependence on leveraged, expensive, and speculative housing values. We should no more regret the demise of expensive housing than we should the decline of expensive oil, both of which are poorly correlated with productive, sustainable economic growth, but strongly correlated with damaging inflation.

Disciplined buyers -- too long unfairly disadvantaged by government policies -- are now sitting on trillions in savings that are earning, doing, and financing nothing. This money could clear the housing market, but only at lower, fairer prices. That would finally be "affordable housing."

Manias begin in obscurity and pessimism, rise with confidence and imitation, reach a state of euphoria and finally end in tragedy. They often change history in ways that are not foreseeable.

Washington Lies About Inflation- Rogers

Some where, John Williams must being feeling somewhat vindicated.

Do You Want to Voice Your Opinion and Name Pluto's Moons

Of course you do.

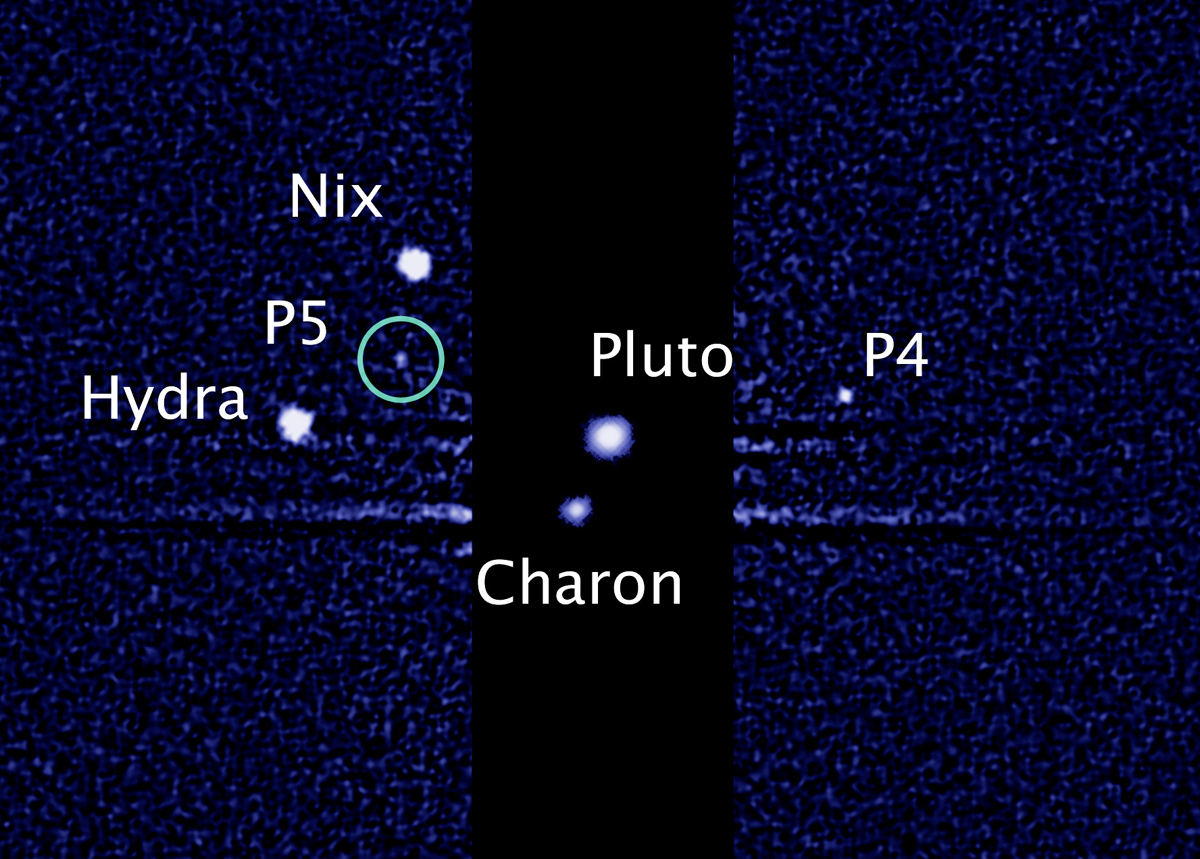

Although it has been demoted from its planet status (and in my opinion should have never been considered as such), does make Pluto any less an interesting region of our solar system. Not only does the dwarf have an atmosphere, at least for a part of its very long year, but it has a number of moons. Two of which were added just in the last two years. The two newest moons join Hydra, Nix, and Charon, that last of which is probably more of double-dwarf system, but I digress.

The newest found partners in the Plutonian system have been granted the uncermonial names P4 and P5. Now however, the powers that be are taking are opinions for names of P4 and P5. Voting will continue until February 25th and can be found here. The three front runners are Styx, Cerberus, Persephone.

Price/Volume Diffusion Index Shows Fatigue But Still Points to Higher Prices

A note on price/volume diffusion index before I get into any updates, you may notice there are changes to the price/volume diffusion index beginning this week comparatively to prior weeks.Although the methodology remains unchanged, I altered the weighting scheme of the component measures. Additionally, the time frame used to calculate a few of the component measures within the index were also shortened in order to receive more timely signals. I will reference the updated model in all future commentary on the price/volume diffusion index.

The price/volume diffusion index remains positively biased, sitting at 61.7 through the close Monday. This is above the 50 level indicating higher price and higher volume levels, and improved from the 56.8 in the week ago period. That said, the diffusion index is down from levels seen in late December last year and early January this year, indicating that demand may be trailing off as prices increase.

Price/Volume Diffusion Index vs. S&P 500

To me, this reflects the step down in upside volume levels in the latest weeks, seen below in the trading of the S&P 500 Spider (ticker SPY).

Additionally, the largest volume increase since November have come in on the downside, suggesting weakening supply and demand dynamics. Despite this dynamic, the market has been pulled higher, as euphoria swept investors following the 'resolution' to fiscal cliff talks in D.C. We shall see if the positive bias continues however, as volume levels in the most recent week has fallen precipitously with equity prices trading into the November and December 2007 downdrafts. This suggests that demand is waning heading into supply lines.

Additionally, the slope of the raw indicator measure remains weak relative to results seen late last year, another negative indicator.

That all said, the market is still likely to go higher from here. Not only is the diffusion index still positive, indicating positive future performance on the market, provided history as a guide, but also the rolling summation indicator remains in an up trend.

For me to turn negative on the market, I would need the price/volume diffusion index to turn down in conjunction with the summation indicator that is rolling over or flattening out. This has not occurred yet, and I would remain positively biased, albeit with reservations.

The price/volume diffusion index remains positively biased, sitting at 61.7 through the close Monday. This is above the 50 level indicating higher price and higher volume levels, and improved from the 56.8 in the week ago period. That said, the diffusion index is down from levels seen in late December last year and early January this year, indicating that demand may be trailing off as prices increase.

Price/Volume Diffusion Index vs. S&P 500

To me, this reflects the step down in upside volume levels in the latest weeks, seen below in the trading of the S&P 500 Spider (ticker SPY).

Additionally, the largest volume increase since November have come in on the downside, suggesting weakening supply and demand dynamics. Despite this dynamic, the market has been pulled higher, as euphoria swept investors following the 'resolution' to fiscal cliff talks in D.C. We shall see if the positive bias continues however, as volume levels in the most recent week has fallen precipitously with equity prices trading into the November and December 2007 downdrafts. This suggests that demand is waning heading into supply lines.

Additionally, the slope of the raw indicator measure remains weak relative to results seen late last year, another negative indicator.

That all said, the market is still likely to go higher from here. Not only is the diffusion index still positive, indicating positive future performance on the market, provided history as a guide, but also the rolling summation indicator remains in an up trend.

For me to turn negative on the market, I would need the price/volume diffusion index to turn down in conjunction with the summation indicator that is rolling over or flattening out. This has not occurred yet, and I would remain positively biased, albeit with reservations.

The VIX and the Outlook for Volatility

Some insights into the recent low level of VIX from Bloomberg and CS. Any regular reader would know that the weighted average standardized VIX is now at levels only seen in one period over in last 12 years.

Subscribe to:

Posts (Atom)