I continue to think we are in a bottoming process. This as the price of the yellow metal has failed to break the June 2013 lows. Additionally, the gold stocks have seen an influx of money (evidenced by a rising, albeit still negative, A/D line) on the down slide in stock prices since mid-October. That said, Wagner provides a deeper take.

Tuesday, November 19, 2013

Monday, November 18, 2013

Shooting For 1,800- S&P 500 Price Volume Heat Map For Nov. 15

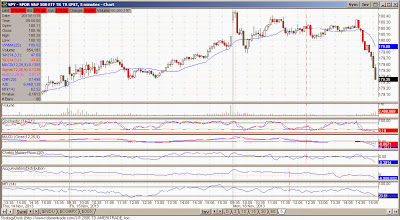

For the latest ended trading day, the S&P 500 gained further still, this time by about 40 basis points, albeit on weaker overall volume trends. That said, all sectors gained on the trading day, and higher equity prices will likely beget higher equity prices. I fully expect the market to hit the 1,800 level, and hope to see a release of information at this point, be it bull or bear.

Despite the overall price gains, the overall supply/demand trends were positive but outside of healthcare and telecom demand was more benign. However, the demand trends was more than enough to offset nonexistent supply. I think that investors are stepping aside from any potential sales at the moment and waiting to see where traders and operators can push equity prices.

For the Week ending Nov. 15

For the most recently ended week of trading, the S&P 500 gained 160 basis points with all sectors except for the telecoms gaining.

And now this is an interesting dynamic. The price/volume heat map for the latest trading week is largely unreflective of the overall equity price gains or that of the sector performance. Healthcare and telecom sectors supply/demand balances align with the price gains, as does the tech sector, but I would have thought demand would have been higher considering the gains in prices. This may suggest some underlying weakness in the most recent run up in equity prices, but I still await the 1,800 level to see more information released.

Despite the overall price gains, the overall supply/demand trends were positive but outside of healthcare and telecom demand was more benign. However, the demand trends was more than enough to offset nonexistent supply. I think that investors are stepping aside from any potential sales at the moment and waiting to see where traders and operators can push equity prices.

For the Week ending Nov. 15

For the most recently ended week of trading, the S&P 500 gained 160 basis points with all sectors except for the telecoms gaining.

And now this is an interesting dynamic. The price/volume heat map for the latest trading week is largely unreflective of the overall equity price gains or that of the sector performance. Healthcare and telecom sectors supply/demand balances align with the price gains, as does the tech sector, but I would have thought demand would have been higher considering the gains in prices. This may suggest some underlying weakness in the most recent run up in equity prices, but I still await the 1,800 level to see more information released.

Sunday, November 17, 2013

Subscribe to:

Posts (Atom)